CME Bitcoin futures price has surged by $2,045 to trade at $8,730 levels currently or spiked by over 28% as the underlying bitcoin price (BTCUSD) has also jumped above $8.5k areas so far in this month. The pair has jumped from the lows of $6,854 to the recent highs of 8,900 levels.

Technically, BTCUSD has formed shooting star followed by hanging man patterns plummet prices below EMAs, but we traced out hammer & dragonfly doji patterns at $7,513 and $7,355.4o levels respectively. Consequently, these bullish patterns counter with vigorous upswings, and the major trend jumps above 21-EMAs.

We had foreseen these indications upfront a fortnight ago and advocated long hedges & trading strategies accordingly, now they must have not only arrested upside risks but also derived leveraged yields on trading grounds.

For now, the bearish engulfing pattern pops-up upon overbought pressures signalled by the momentum oscillators. At this juncture, this would be perceived as a better entry levels provided by the bears for fresh traders.

The market veterans reckoned and gave the credit to the launch of CME BTC options likely contributed to the surge in an evolving cryptocurrency derivatives markets.

On 14th of this January, the pair (at Coinbase exchange) has shown a single day price jump of about 8.78%.

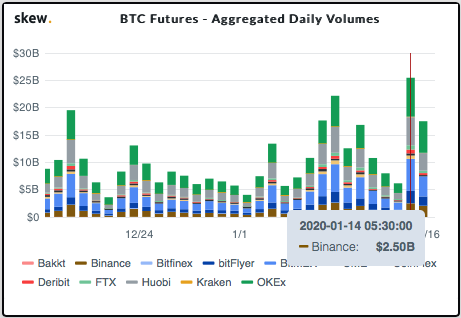

As a result, the bitcoin derivatives trading flashes with its highest trading volumes on that day, while open interest in Bitcoin futures, for example, has soared to $3.5 million, as per the data compiled by Skew. On a fresh long build-up (rising price) coupled with the rising open interest and rising volumes is conducive factor for the contract holders.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary