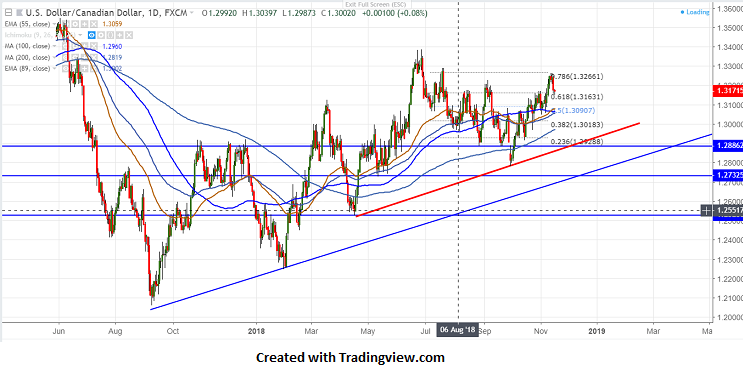

USDCAD has halted its bullish trend after massive 450 pips jump from low of 1.2780 made on Oct 1st 2018. The Canadian dollar was trading weak and hits 4 -month low on account of huge plunge in crude oil prices. The pair hits high of 1.32636 and shown a 100 pips decline from that level. It is currently trading around 1.31680.

Brent crude has shown huge decline of more than 25% from the high on account of increase in supply from Saudi and also continuous increase in US crude oil inventory. It hits low of $64.69 and is currently trading around $67.40.

With no major events in US today market eyes Canada manufacturing sales for further direction.

The near term resistance is around 1.3200 and any break above targets 1.32661 (78.6% fib)/1.3300.

On the lower side , major support is around 1.3135 (20- day MA) and any break below targets 1.3070/1.3050 (89- day EMA).

It is good to buy on dips around 1.3135 with SL around 1.3070 for the TP of 1.3260.