We immediately took the view that the adjustments of the Japanese monetary policy implemented by the Bank of Japan last week amounted to a capitulation on the part of the BoJ. In the meantime, reports have emerged that the BoJ considered rate hikes twice this year. That confirms our fears that the more flexible interpretation of the yield curve target was nothing else but the beginning of the end of ultra-expansionary monetary policy in Japan.

USDJPY had remained in a narrow range (2% from mid-109 to mid-111) until early this week as both USD and JPY moved together.

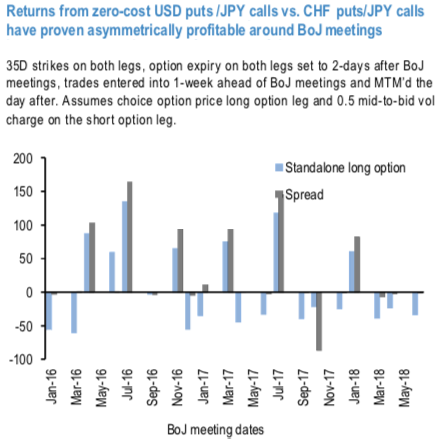

Buying long USD puts/JPY calls around the events provides with a decent performance since 2006 (refer above chart).

However, considering zero cost structures long USD puts/JPY calls vs short CHF puts/JPY calls (assuming 0.5 mid- to-bid charge on the short leg) delivers much more convincing results, with a (on average) positive and highly asymmetric stream of returns.

The long/short strategy underperformed the long only position in only two of the seven market-moving meetings, delivering a negative P&L in just one occasion.

This looks like a good opportunity for positioning for a hawkish BoJ in the months to come.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 84 levels (which is bullish), while JPY is at 111 (bullish) while articulating (at 13:10 GMT). For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan