Trade headlines remain the focus for now. Media reported that President Trump was surprised when he heard that Steven Mnuchin requested the Chinese delegation to cancel the farm tour. "Why was that our request, just out of curiosity?"Trump asked. Mnuchin explained that the US side "didn't want confusion around the trade issues."Trump then interjected: "Yeah, but I want them to buy farm products."

In the meantime, Mnuchin confirmed that the next round of trade talks will take place in the week of 7 October, and China's top negotiator Liu He will visit Washington. Mnuchin also mentioned that the most important China issue is intellectual property. It seems that the US has somehow softened the tones on trade talks (at least to me), because over time the US insists that the most critical issue is so called "enforcement mechanism".

Under this system, any breach of the trade deal would result in different levels of sanctions from the US side unilaterally, which is seen by China would dilute its sovereignty. Certainly, it might be too early to make a judgment for now as Mnuchin is normally taking a relatively soft approach in the trade talks.

Compared to the trade headlines, USDCNY is a bit less dynamic - fixing is again extremely stable, and USDCNY is hovering around 7.10 for a few sessions already.

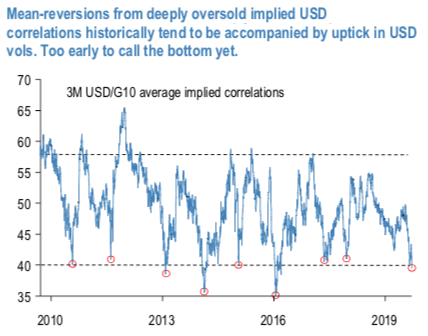

While FX vol shorts may be on borrowed time as USD correlations dropped below 40%, in the first time since 2016 (refer above chart). We are only very tactically willing to sell risk premium and only via defined downside short vol structures such as 1M USDTWD or better yet in crosses such as EURCNH at-expiry strangles.

Once can finance post-October hedges in the form of USDCNH upside by selling slower moving USDTWD topside in zero-cost structures.

So, at spot reference: USDCNH - 7.10, USDTWD – 30.990, consider zero cost 4M USDCNH 7.30 (25-delta) call financed by selling 4M USDTWD 30.95 call, spot ref 7.085 for USDCNH and 30.94 for USDTWD and vols for strikes 6.65 and 4.9 respectively. Courtesy: JPM & Commerzbank

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts