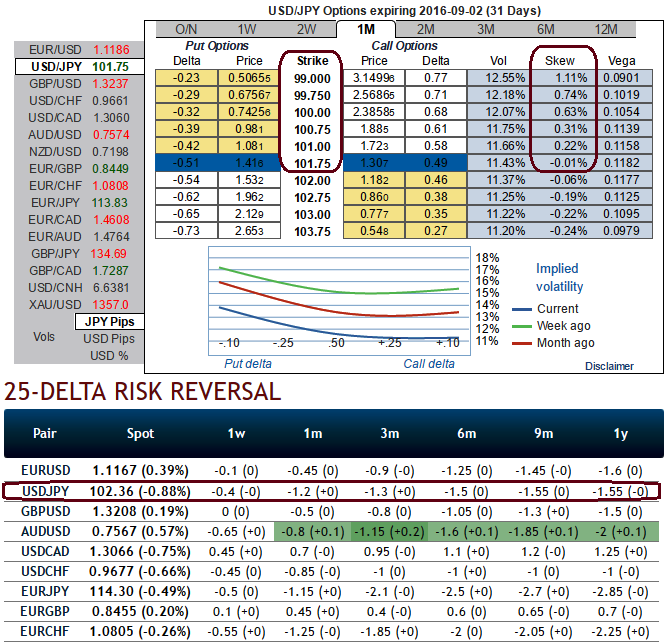

Wise to note that 1M USDJPY ATMs fell from 15.0 pre-meeting to 11.5, significantly undershooting the 1-day forward vol prediction (11.85) despite a 1.5% spot decline on the day, which ought to have provided a modicum of support for vols.

Yen IVs: Live September meeting should keep 2M vol supported; while yen 1-3m risk-reversals still a better sale. Please be noted that the 1m IV skews are more biased towards OTM put strikes, significant changes can indicate a change in market expectations for the future direction in the underlying forex spot rate and these risk reversals evidences the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market.

Even less event-sensitive longer-dated vol sold off hard (3M -1.3, 1Y -1.55), possibly indicating the market’s long vol pre-positioning going into the event that the (non) event proved to be unjustified.

There was also a valuation issue at play, in that yen vols had lagged the sharp collapse in VXY prior to BoJ – held up in all likelihood by the outside chance of a policy regime shift in Japan –and were ripe for a sell-off if the meeting proved uneventful.

The key takeaway from this week’s BoJ is that the September meeting is ‘live’and will feature another will they or won't-they redux, hence ought to command a good amount of event risk premium, perhaps even comparable to the July meeting. If we are right, 2M options spanning the September BoJ should trade at a premium to surrounding points on the curve.

The yen term structure has already repriced to reflect this event bias –2M ATM vols trade 0.6 % pts. over 1M and 3M ATMs – but 3W-4W vols still trade almost at par with 2M.

This presents a theta-efficient opportunity to tactically play for higher USD/JPY into the September BoJ via short 3W vs. long 4W USD calls/JPY puts (e.g. 105 strikes). The tail risk of regime shift in September also means that short yen and cross-yen risk reversals the correct risk-reward trade.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook