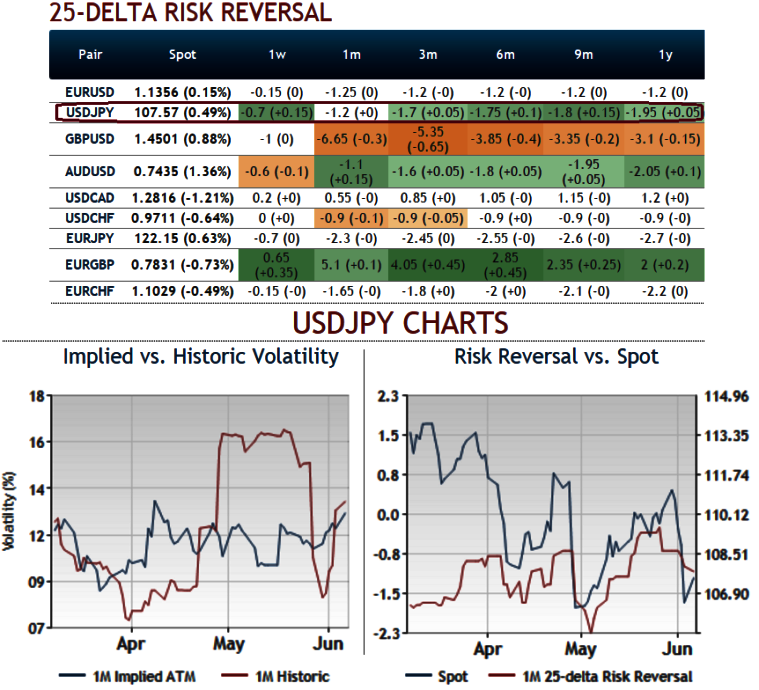

We know that delta risk reversals indicates the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC FX market.

As you can observe the delta risk reversals of USDJPY, hedging sentiments for bearish sentiments has been reduced over the period.

Negative flashes of these numbers indicate puts are more expensive than calls (downside protection is relatively more expensive).

Any significant shift in risk reversal numbers in opposite directions indicates a change in market sentiments for the future direction in the underlying FX spot rate.

Thereby, put options that give you the right to sell US dollars against Yen are on higher demand but underlying market sentiments are changing ever since speculations Fed’s monetary policy stances as there was no clarity from Fed chief Yellen’s speech.

The S&P index continues to edge ever closer to last year's all-time high, unperturbed by signs of softness in the economy or indeed, by the downturn in corporate earnings.

The Fed's on hold for now and probably until after the Presidential Election and that's all that matters.

Fed Chair Yellen's speech in Philadelphia yesterday reaffirmed a desire for gradual interest rate increases and could have been read as a sign that the FOMC isn't going to be deterred by one month's weak employment data.

But the market focused instead on the Fed's data-sensitivity. They seem to be keener on markets pricing in the possibility of a rate move than actually delivering one.

And while markets view the world in that way, then riskier assets will continue to find some support. EMFX bears will have to be patient, and indeed, we're getting no joy today out of shorts in AUD, NZD or GBP either, but I still don't understand why the yen isn't weaker.

CAD/JPY, for example, has scope to re-couple with risk sentiment now that oil prices are steadier and the lurch up in Japanese real yields is behind us. USD/JPY looks out of line with the most recent real yield moves, let alone with the S&P.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed