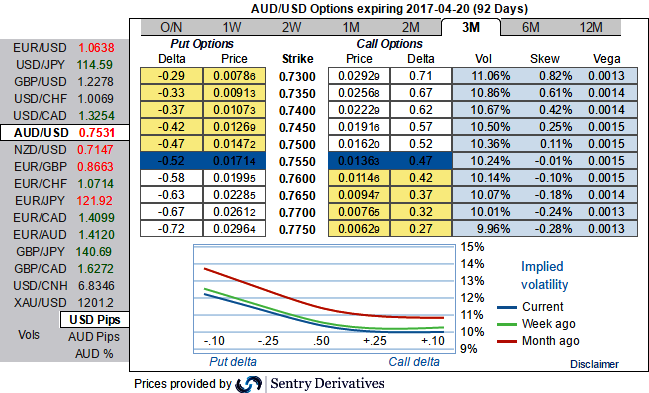

AUDUSD's higher IV with negative delta risk reversal can be interpreted as an opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Fed Chair Yellen delivered hawkish comments on Wednesday, adding that the economy is approaching the Fed's dual mandate of inflation and employment. She further mentioned that the US is near full employment and with inflation figures stabilizing, there is a need for gradual Fed tightening, although she did not mention the exact timing of an interest rate hike.

Hence, as shown in the diagram, contemplating the above risk reversal computations, we construct strategy comprising of both calls as well as puts in the ratio of 2:1 so as to suit the swings on either direction.

In the major downtrend of this pair, capitalizing on reducing IVs we eye on shorting out of the money calls with shorter expiries which would lock in certain yields by initial receipts of premiums and risk reversals to favor longs in puts in lengthier tenors.

Well, here goes the strategy, go short in 1m (1%) OTM calls and simultaneously, 2 lots of 3m puts (+1% ITM, and ATM strikes) are preferred to suit the prevailing losing streaks. So thereby the combination would be executed for net debit and the cost is reduced by short side.

Moreover, the strategy could be counterproductive as the positively skewed 3m IVs to favor OTM puts strikes (please refer IV nutshell).

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty