Yellow metal prices spiked off to a two-week high during Europe's session on Thursday, as the US dollar tumbled after the Fed held off on raising interest rates and scaled back the number of rate hikes it expects next year.

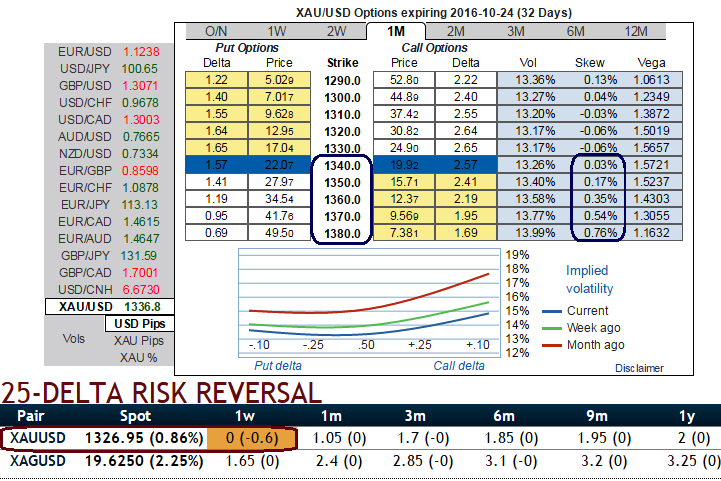

Let’s now be noted that the 1m IV skews of gold are more biased towards OTM call strikes, significant positive changes can indicate a change in market expectations for the future upward direction in the underlying spot bullion rate.

Whereas on the contrary, the bullish sentiments are evidenced on the hedging arrangements, instead they’ve been still sceptic on gold’s recovery in prices and the negative and neutral risk reversals of 1w and 1m tenors evidence the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market.

Since, the pair has shown robust strength and is on verge of reversing the direction to the short term upswing minimum up to 1338 level that is where it is deemed as a consolidation phase, as it is has bottomed out at strong supports at 1308 levels yet again and cleared resistance of 1334.579, provided it holds and sustain above these levels or in other words where the spot FX price action has become tighter and where volatility would shrink away in advance of a big move in either direction. Typically, we’re looking for a pennant within the context of an upward trend.

After going through the above fundamental and technical reasoning, we hope what the trend is intended to be at this juncture and if you compare the prevailing price of XAUUSD with the recent swings it would be more convincing.

In near term, as the daily chart popping up some buying interest that would result in some price recoveries from there onwards but long term trend needs clarity in the direction.

As a result, we recommend building the portfolio with longs positions in 2 lots of 2W ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 2W expiries.

Since the upswings are anticipated in near term, this option straps strategy should take care of both upswings and any abrupt downswings, and yields handsome returns on the upside in the short term.

Investors need to be optimistic that the volatility in the underlying spot would occur during the short lives of the options. Preferably, the movement will occur towards the leveraged side. If the hoped for price swing does occur, these strategies can be quite rewarding.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022