Market risk sentiment was mixed in Asia ahead of the US Fed policy decision later today which seems to be factored in FX markets. The US Federal Reserve is expected to raise policy interest rates by 0.25% this evening, in spite of recent mixed economic data. Over and beyond to-day’s 25bp rate hike the Fed expects four further rate steps until the end of next year, the market only one or two.

The old conflict between what the markets expect and what the Fed suggests has been re-ignited. This does not involve a rate hike expected for today which is completely priced in on the market and which therefore constitutes a non-event. What is decisive for USD is the monetary policy outlook beyond today.

More importantly, on the BoJ’s policy front, the Japanese central bank may explain their exit policy carefully to communicate with the markets on June 16th meeting. If market participants speculate that the BoJ’s exit may take place in a not-too distant future, it should be positive for JPY through higher JGB yields and a narrower US-Japan long-term yield gap.

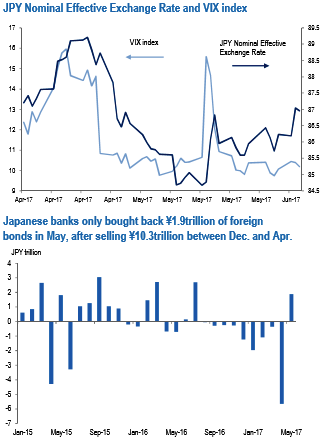

According to the monthly portfolio data, Japanese banks only bought back ¥1.9trillion of foreign bonds in May, after selling ¥10.3trillion of them between December and April (refer above chart). Japanese banks probably needed to buy back more foreign bonds to get sufficient carry (note that banks’ foreign bonds investment is usually financed by foreign currency, therefore it has no impact on FX), which would contribute to lower UST yields and weigh on USDJPY.

USDJPY declined on the back of US political uncertainties due to President Trump’s scandals and declining UST yields. The plunge in mid-May was mainly attributable to JPY appreciation amid deleveraging due to the US political uncertainty. While USD weakness also contributed to lower USDJPY, the Yen appreciated more than 2% in trade-weighted terms in the past month (refer above chart). USDJPY extended its downside to 109.12 on June 7, the lowest since April 21.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal