Although, on long term basis USDCHF has slight uptrend sentiments but we expect range bounded movements in short to medium terms considering the increased volatility (projected a gradual increase in 1m-3m ATM contracts at 10%) and neutral delta risk reversal (this has been explained in our recent article).

Currency option framework: (USDCHF Condor spreads)

It has been gradually reducing to 8.6% but it is projected to rise for contracts with 1m or 3m expiries, while delta risk reversal being neutral, this would mean that there is no much speculation in option markets but it does not mean that foreign trades having this currency exposure can be rest assured with open portions. When we had to study and compare this fluctuation of volatility and its comparison with risk reversal we tend to increase upper limits in the range determine for this pair as a result of increase in the IV.

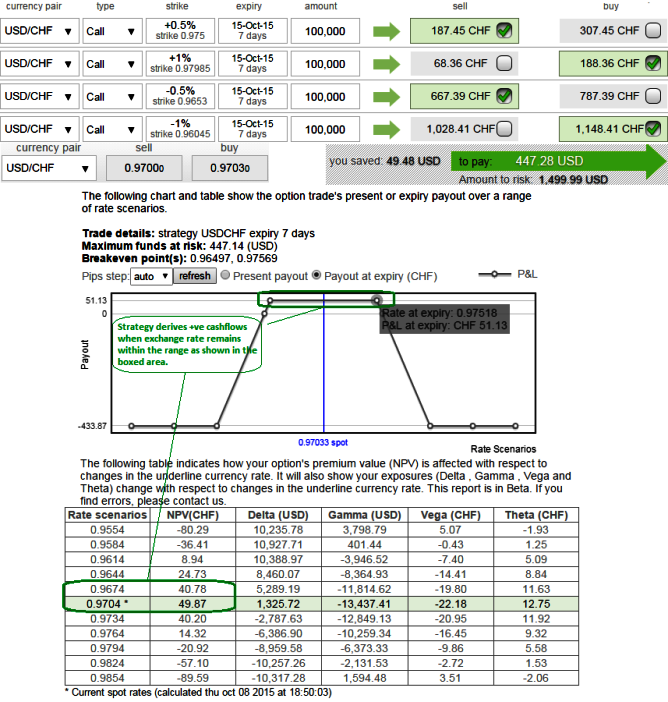

So here goes the strategy this way, we advise shorting OTM call and buy deep OTM calls, simultaneously short ITM call and deep ITM call options with identical maturities. The highest loss for this option strategy is equal to the initial debit taken when entering the trade. It happens when the underlying exchange rate on expiration date is at or below the lowest strike price and also occurs when the pair is at or above the highest strike price of all the options involved.

FxWirePro: Wise to change USD/CHF iron condors into condor spreads on increasing vols

Thursday, October 8, 2015 1:29 PM UTC

Editor's Picks

- Market Data

Most Popular