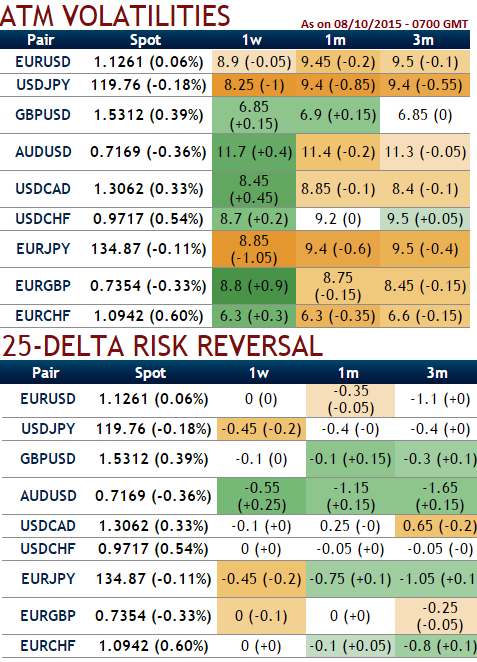

From the above table showing delta risk reversal and ATM volatility, it is evident and understood that this instrument has been absolutely stagnant and it would remain the same range in future but little bearish bias. As a result, to justify this stance, for short term traders the pair seems to remain in range between 0.9850 on northwards and we've reduced downside threshold a little more up to 0.9570 levels on southwards.

Implied volatility makes no predictions about future price swings of the underlying pair but when it is compared with delta risk reversal we may get some sort hints about the market sentiments, since the relationship is tenuous at best. Implied volatility can change very quickly, even without any change in the volatility of the underlying asset. Although implied volatility is measured the same as volatility, as a standard deviation percentage, it does not actually reflect the volatility either of the underlying asset or even of the option itself. It is simply the demand over supply for that particular option, and nothing more.

It is explained as to why use a risk reversal in USDCHF pair and you would enter into a risk reversal if you want to hedge your underlying risk while lowering the cost of this premium. A risk reversal is made up of two transactions that together take into consideration the implied volatility of both put and call options. For example, the combination of a 25-delta currency call together with the same delta put is known as the risk reversal.

For an instance, you can buy a USD/CHF call to cover the risk of an increase in the value of the underlying asset. Simultaneously, you sell a USD/CHF put. Although the put limits any upside should the underlying actually fall in value, it also significantly reduces the cost of the overall strategy.

Any existing shorts in underlying position, then you would buy a risk reversal (long on call and short on put) and Long underlying position you would sell a risk reversal (i.e. long on put and shorts on call).

FxWirePro: Increased IV and delta risk reversal suggests expanded USD/CHF range bounded trend

Thursday, October 8, 2015 12:58 PM UTC

Editor's Picks

- Market Data

Most Popular