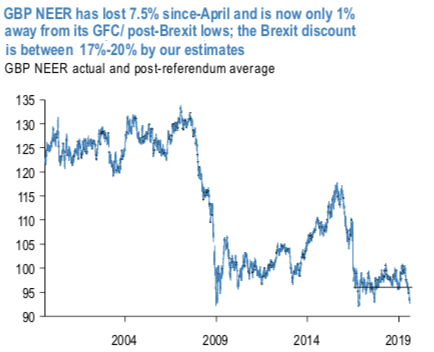

A renewed focus on the UK’s political developments has caused GBP to extend its underperformance over the past month, making it among the worst-performing G10 currencies over this period. The trade-weighted index has weakened by another 3% over the past month, leaving it just 1% away from the post-Brexit and GFC lows. With this move, GBP appears to be quite cheaper (20%) than the 20-year average pre-Brexit (refer 1st chart). The Brexit discount ranges between 17% and 20% by JP Morgan’s projections — GBP REER is 20% cheaper than the pre-Brexit average and 17% cheap to its 20-year average.

The key driving force of the recent GBP weakness has been an increasingly hardline stance by the new PM on Brexit negotiations as evident in ramping up of preparations for a possible “no-deal” outcome, Gove indicating that “no deal is now a very real prospect”, Boris Johnson’s office hinting that the next round of Brexit talks might not happen at all and apparent insensitivity of the government to recent GBP weakening. The simultaneous increase in the share of polls in favor of the Tories has not helped matters, even if it was expected following May’s departure and has come at the expense of the Brexit party (refer 2nd chart).

The economists note that with the recent advance, the Tories are on the cusp of gaining a small majority without requiring support from the Brexit Party. On this backdrop, at times, the FX market seems like exasperating.

On the flip side, the fact that chancellor Angela Merkel and President Emmanuel Macron did not expel prime minister Boris Johnson and his country right out of the EU yesterday seems to bode well for the GBP in the market’s view. Precisely nothing has become better, simpler or safer since yesterday. Merkel and Macron still agree with each other, Merkel still sounds slightly more conciliatory, Macron somewhat harsher. And neither wants to take the blame if things end in chaos. And why should they? Johnson does that all on his own.

But we’ve known that for quite a while. Why then do FX traders see this as an opportunity to revalue the GBP? If anything, the opposite makes sense. On his trip to the oh so hateful continent, Johnson did not advance a single inch. But with the day of “do or die” (“We are getting ready to come out on October 31st. Do or die”) approaching by the minute, the chances that the EU will give in keeps decreasing. Everybody trading in GBP should be aware of that. However, this does not seem to be the case.

We have been recommending GBP shorts since Brexit saga (especially from May), but recently rotated exposure to options as a tail risk hedge. Spot trades initiated in May were expressed vs USD and JPY. We took profits on these trades in early August, not because we thought prospects for GBP have improved but because valuations were approaching record lows. Moreover, investor shorts are now a mere 5% smaller from a record (refer 3rd chart).

Nonetheless, further weakening is likely—Johnson’s rhetoric is unlikely to soften in the near-term—but positioning and valuations lead us to conclude that GBP hedges are better expressed via limited downside options. We thus activated short sterling via a limited loss tail hedge: Stay short a 2M GBPUSD 30d/10d bear put spread with strikes at (1.2416/1.2015) at spot reference of GBPUSD: 1.2227 levels.

On trading perspective, it is advisable to execute boundary spread options strategy with upper strikes at 1.2375 and lower strikes at 1.2150 levels, thereby, one can achieve certain yields as long as the underlying spot FX keeps dipping below lower strikes on the expiration.

Alternatively, on hedging grounds, long-term investors are advised to maintain short positions in futures contracts of mid-month tenors. The writers of the futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: JPM

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields