Before we begin with the strategy run through, let’s have a glance on the underlying spot movements of EURCHF and the OTC FX updates.

EURCHF’s range bound pattern is still persisting for about more than a year or so, from last three months the pair has been spiking above but for now, some bearish candles are indicating slight weakness that bring the swings back into the long lasting non-directional trend, (Ranging between upper strikes 1.1110and lower strikes at around 1.0725 levels).

We could still foresee range bounded trend to persist in near future but little weakness on monthly charts is puzzling this pair to drag southward targets but very much within above stated range.

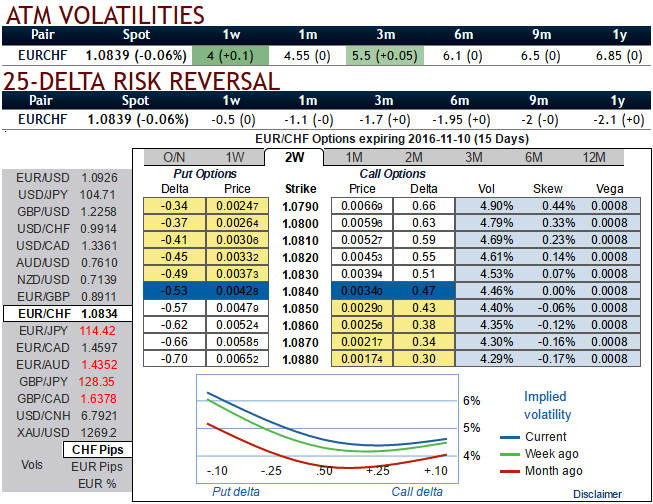

Elsewhere, please be informed that the implied volatilities of EURCHF ATM contracts of all expiries have still been the least among G10 FX space across all tenors.

To substantiate all these stances, observe 25-delta risk of reversal of EURCHF that has also not been indicating any dramatic shoot up nor any slumps (bearish-neutral), but seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier.

CHF was a prime candidate with SNB’s balance sheet size which has continued to grow by as much as 20%pts of GDP since the floor collapsed in 2015.

While skewness in the 2w tenors has also not been signifying any melodramatic sentiments that could anticipate a considerable shift in the underlying spot FX. We hardly notice 0.22% positively skewed IVs for about 40-50 pips movements in the underlying spot.

As a result, we recommend below option strategies using right options, thereby, one can benefit from certain returns.

Option Strategies: (Naked Strangle Shorting)

Shorting 2W OTM put (1.5% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (1% strike referring upper cap) would fetch us certain yields as long as the underlying spot FX remains between these strikes on expiration (we reiterate, preferably narrowed maturity is desired in this strangle shorting).

Alternatively, one can also perform iron condor on the same lower IV circumstances.

To execute the strategy, the options trader buys a lower strike OTM put, sells a middle strike ATM put, sells a middle strike at-the-money call and buys another higher strike OTM call. This results in a net credit to put on the trade.

Overview: Slightly bearish in short term but sideways in the medium term.

Time frame: 2 weeks

At current spot at 1.1016 with range bounded trend keeping in consideration, we would like to remain in the safe zone by achieving certain returns though these neutral strategies.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges