If plot the weekly charts of Bitcoin, you would probably be puzzled by its price oscillation.

Since the 1st week of February, unlike normal Forex trading which has seen low volatility in the recent times, crypto-asset has been highly turbulent, nobody knows what trend direction it has going forward except industry’s growth stage.

However, the price movements of BTC are quite sufficed to make some handsome returns with your capital. Margin trading is a thing to compensate for the micro price movements with Forex, unlike with bitcoin how it can move $100 in a week easy.

You may be baffled as to how do you know when to short then? With trading, fundamental & technical analysis that is the result of making good trades. For trading, it just needs proficiency in reading the candles or indicators such as an EMA (exponential moving average).

Well, in this write-up, we emphasize on a trading strategy so as to make money regardless of bitcoin's price goes in uptrend and downtrend. If you can learn to hedge bitcoin effectively, you'll always be growing your trading account. You don't have to keep investing or continue to deposit coins every so often.

Hedging using derivatives contracts is ostensibly referred to as an advanced trading strategy, the principles are quite simple. It's just the process of selling high and buying back low.

It seems not as easy as merely saying, tough to hedge or just not worth it as the underlying asset has just encompassed inception stage and is just in its growth stage.

The type of response is just a limiting belief, so don't be blinded. It's actually pretty simple.

You'll need to know the fundamentals of technical analysis to be able to predict when the price will go down for hedging. This short guide isn't to teach you about technical analysis, but what is hedging and how and when to apply it with trading bitcoin.

With a great deal of frankness, we vouch it is not recommended paying for trading courses and stuffs like that. The best advice for trading bitcoins is to watch the price chart and underlying news on a regular basis, choose the right and reliable broker. Some well-known names such as Coindesk has the latest news for you to keep updated.

Bitcoin's price behavior is the single reason why you're able to make huge gains from hedging. The price movements being as high as $100 in one day isn't a bad thing at all for traders. It's an amazing opportunity for smart traders to make more gains.

The reason we say the big price movements aren't a bad thing is that it's all on an upward trend. It's not like bitcoin is in a sideways market. It's been an upward trend since late 2015. Whenever the price shoots up during the steady trend, it'll eventually go back down, but it'll always continue to regain somewhere above the major support trendline that it's been climbing on like it did $6,406 levels.

As BTC price was almost about to break through with constructive news and the Winklevoss ETF that could have been approved, But US SEC didn’t approve, thereby, it only sounds like this type of price behavior will continue.

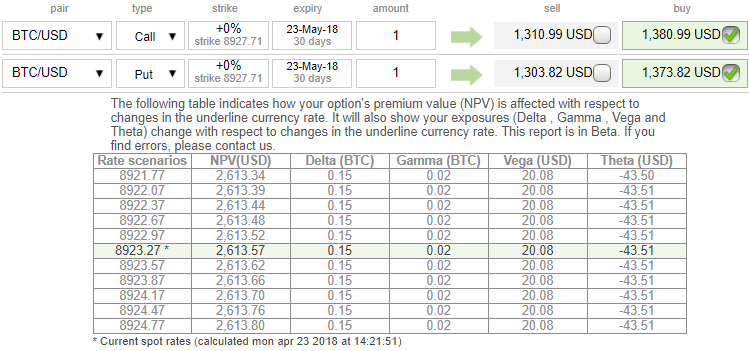

Having mentioned that, there exists to be huge room for smart hedging so that one can grow their account way bigger than they expect. The above chart is just diagrammatic expression of option straddle strategy. You can observe, such OTC type options likely to fetch handsome yields regardless of swings in underlying BTCUSD.

Be aware that the liquidity part would be the challenging thing if you consider the NPV factor, such options are on upper hand.

Any hedge fund manager can rest be assured with the efficient performance of this strategy when BTC holdings face any price turbulence.

Currency Strength Index: FxWirePro's hourly USD spot index has shown 154 (which is highly bullish), while hourly BTC spot index was at 158 (highly bullish) while articulating at 08:57 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary