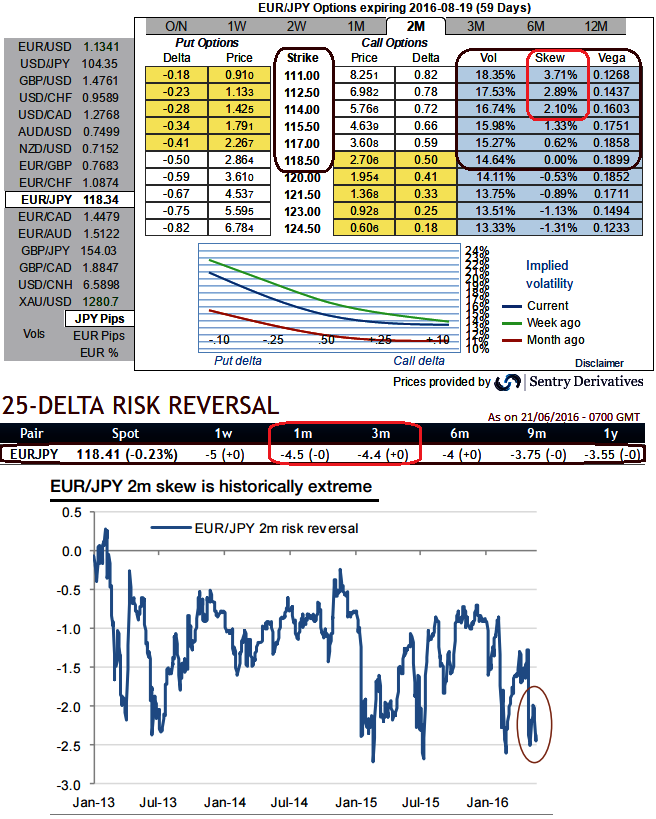

Short the extreme EUR/JPY skews as shown in the diagram.

The next two months would observe numerous developments, including notably the UK referendum outcome.

Expression: The EUR/JPY 2m risk reversal is trading at extreme historical highs in favor of yen calls, close to the peak at -2.5 vols (see graph). The options market is pricing that yen appreciation will be more volatile than a yen fall.

This does not necessarily mean that the spot will move significantly but rather that downside price action is expected to be more erratic. This suggests taking advantage of the left side of the smile by building a strategy selling these expensive low strikes, like a put spread ratio.

Selling high volatility in that region enables a reduction of the downside risk embedded in such a structure, and a large skew makes it possible to sell more distant strikes.

Rationale: With toppish oil prices, woes in China and the bouncing dollar, risk conditions could turn shaky soon and the yen would be a winner. Near term, short EUR/JPY takes advantage of both a stronger yen and dollar via a lower EUR/USD. As a euro short, it would also hedge a Brexit scenario.

The execution:

Buy EUR/JPY 2m put spread 1x2, strikes 121/112

Indicative offer: zero cost (spot ref: 118.010)

This strategy is short volatility, which is attractive as the 2m implied vol is trading one volatility point above the realized volatility (positive risk premium).

The profile is, however, shorting convexity, such that a very fast downside move would deteriorate the mark to market.

In that event, investors may have to dynamically manage the delta to avoid losses. The positive theta makes it a natural buy-and-hold strategy, as the structure pays off its maximal leverage if the spot trades close to the 118 strike only near the expiry.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures