Emerging markets’ currencies have rallied about 2% from its year-to-date low in September 2nd, and the BRL beta adjusted seems to have lagged this recovery. This is a significant relative strength indicator as a short-term driver of BRL price action, in our view, and in the event that EMFX sees less pressures ahead BRL should catch up. Further, our short-term valuation models of the BRL explained by 2-year interest rate differentials, soft commodity prices, 10-year US treasuries and oil prices are showing the BRL about 6.5% cheap, with a fair value at 3.80 vs. the current level of 4.05 (25 cents cheap).

In fact, the oil attack over the weekend seems to have stop short a slight improvement in Latam currencies' tone, thanks to a "temporary deal" between China-US appearing, and ECB stimulus.

Stay OW BRL despite BCB dovishness. We maintain that the BRL is among the cheapest currencies in our region, and short BRL positions from speculative accounts have increased to the highest level this year, with BM&F data indicating long USDBRL positions at $37bn.

On one hand, lower growth and rates have taken a toll on BRL, but seem priced at this stage; GDP consensus estimations, as published by Bloomberg’s ECST seem to have stabilized, with 2019 GDP consensus estimations being little changed since mid-august.

Meanwhile, J.P. Morgan economists recently revised their 2019 GDP expectations to 0.8%, up from 0.7% before. On the other hand, political reform is still under way and the potentially large BRL inflows from the privatizations and oil auctions not far behind. We note that, according to the CNPE (National Council of Energy Policy), the excel oil auction will occur on November 6th, and the signing bonus of BRL106bn to be received on December 27th.

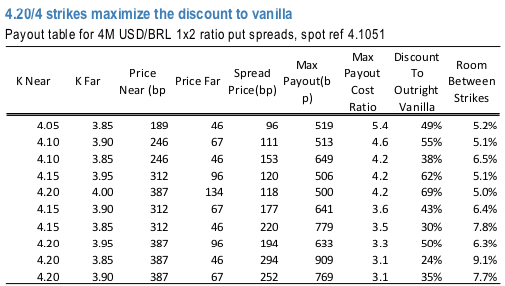

Risks of delays exist, particularly since this is a very tight schedule, but market participants may anyway position ahead of these dates, and the foreign O&G companies involved are likely to convert their FX into BRL ahead of this time frame. We also recommend a 1x2 USDp/BRLc structure (4m, K = 4/4.20) costing 118bp. Courtesy: JPM

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?