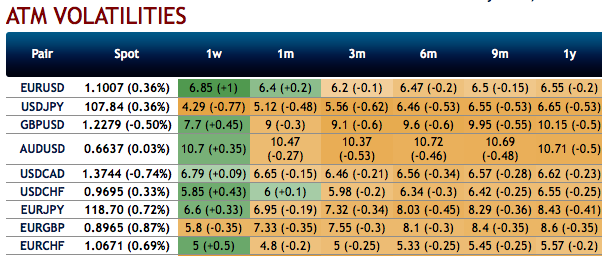

FX vols underwent through a bi-modal pattern since late February, rising sharply until around March 20th and dropping almost as steadily since then. Currently, G10 IVs are dipping again considerably (refer above nutshell). The rise was associated with the “shock” component linked to the most acute phase of the COVID-19 crisis. Current valuations appear to be benignly pricing the economic follow-up to the health crisis. VXY-G10 pricing is less than 3vol pts from the mid-February all-time low.

Accordingly, tactical gamma indicator is firmly back into the FX short vol territory. Defensive vol positions are clearly feeling it. Rather than scrapping them we suggest alleviating the pain by adding risk harvesting legs.

While yielding attractive risk/reward DNTs fade elevated vol premia at defined downside. 3M EURJPY and USDTWD top the ranking based on the binary range vs the trading range measure.

Waning directional drivers support de-correlation (USDCAD > USDCHF <) dual digi that comes at 65% discount.

Fade risk premium baked into NOK wings via delta- hedged 6M ATM/25D symmetric fly or ATM/25D/10D call fly.

Sharply higher political noise lifted USDCNH skew to the top of the EM pricing but that skew is bound to underperform amid capped spot weakness.

Performance of the FVA / delta-hedged ratio put spread packages has been historically robust and can ease the pressure on defensive yen fwd vols positions.

We develop a framework for optimal sizing of vanilla options across strikes based on a utility maximization approach that trades on disagreement between option implied and historical distributions. Courtesy: JPM

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays