In this write-up, geo-political issues surrounding oil this year have been extensively emphasized. The interplay between oil, power and politics given the recent increase in geopolitical uncertainties affecting oil are highlighted.

A lot has changed since the formation of OPEC 58 years ago, including OPEC participants and the demand for oil, but the importance of OPEC in relation to global politics has remained firm over time.

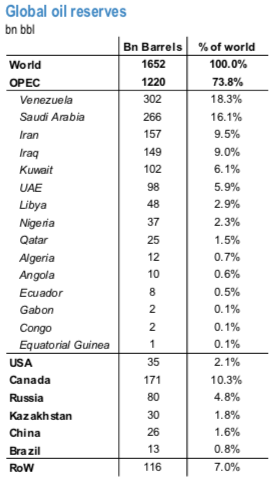

Although oil has always been a cyclical industry, geopolitical risks, especially those coming from OPEC producers, have greatly contributed to the volatility in oil prices. The sheer size of OPEC’s supply makes it a big stake holder in oil markets. OPEC producers control close to 40% of the global oil supply (including Natural Gas Liquids) and their proved oil reserves account for 74% of global oil reserves (refer above chart).

However, despite the attempts made by OPEC to dampen oil price volatility, OPEC has always been surrounded by heightened geopolitical events. The price response to geopolitical risk is higher from OPEC’s Middle East members, as those countries account for 73% of total OPEC supply and also control one of the main conduits to oil flow, i.e. the Strait of Hormuz.

Furthermore, the Global Terrorism Database reveals that in 2017, 35% of total terrorist attacks in the world took place in the Middle East and North Africa and have impacted supply in the region resulting in oil price volatility.

As markets have returned to their equilibrium, OPEC’s role in geo-politics has become as prominent as it was pre-2014, which has impacted oil prices, once again.

The number of global hits for the search terms “oil”, “Iran”, “Saudi Arabia” or “OPEC” on Google has far surpassed the levels seen in the last three years, especially around some of the key decision dates this year.

The United States’ involvement as the second largest producer of crude and oil products has changed the global oil dynamics and politics especially as they sell more crude into OPEC’s stronghold in Asia.

Iran oil sanctions and Jamal Khashoggi’s saga are clear examples of the indisputable role geo-politics play in oil, and this is expected to impact oil price and volatility at a time when markets are just about balanced.

Trade recommendation: Squared-off the longs in WTI Jan’19 short Feb’19 tactical trade, while maintain the longs in Dec’19-Jan’20 Brent spread for long-term investors. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at 95 (which is bullish), while articulating at 13:12 GMT.

For more details on the index, please refer below weblink:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close