Global crude oil futures prices have eased data from the American Petroleum Institute suggesting that U.S. stockpiles rose by more than forecast last week. With WTI is edging higher $26 a barrel and Brent futures inched shy above $30 a barrel.

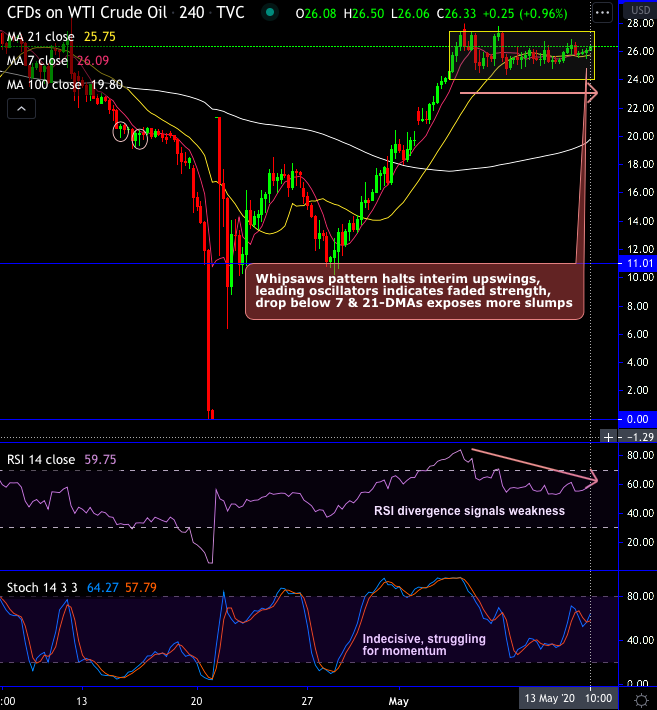

Technically, WTI crude price chart forms whipsaws pattern after brief rallies up to the peaks of $27.95 levels. Consequently, the bearish pattern halts interim upswings, while leading oscillators indicates faded strength, the price drop below 7 & 21-DMAs likely to expose more price slumps.

On a broader perspective, we could foresee no traces of recovery in the near future, price has tumbled below 7, 21 & 100-EMAs, it has retraced more than 88.6% Fibonacci levels of 2018 highs in this journey (refer monthly chart). While both leading & lagging indicators signal weakness on this timeframe.

OPEC and its allies intend to maintain existing oil cuts beyond June when the OPEC+ group is next due to meet to shore up prices and demand, which has been hit by the pandemic Covid19.

Hence, we advocated shorts in CME WTI futures contracts of far-month tenors with a view to arresting further dips, since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for May month deliveries.

FxWirePro: USD/JPY gains some ground but bearish outlook persists

FxWirePro: USD/JPY gains some ground but bearish outlook persists  NZDJPY Poised to Break Higher: Buy-the-Dip Strategy Above 91.40 Support

NZDJPY Poised to Break Higher: Buy-the-Dip Strategy Above 91.40 Support  USDCHF PPI-Powered Spike Fades: Sell Rallies Near 0.7750 – Eyes 0.7500 Drop

USDCHF PPI-Powered Spike Fades: Sell Rallies Near 0.7750 – Eyes 0.7500 Drop  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: EUR/ NZD heads deeper into bear territory, 23.6% fib eyed

FxWirePro: EUR/ NZD heads deeper into bear territory, 23.6% fib eyed  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: GBP/AUD downtrend slows, but bearish sentiment remains

FxWirePro: GBP/AUD downtrend slows, but bearish sentiment remains  GBPJPY Bulls Stay in Charge: Holding 210 Unlocks 214+ Upside – Buy the Dip

GBPJPY Bulls Stay in Charge: Holding 210 Unlocks 214+ Upside – Buy the Dip  EURJPY Trapped in Bearish Squeeze: Sell Rallies Near 184 – 180 in Sight

EURJPY Trapped in Bearish Squeeze: Sell Rallies Near 184 – 180 in Sight  FxWirePro: EUR/AUD falls below 1.7000, bears keep the advantage

FxWirePro: EUR/AUD falls below 1.7000, bears keep the advantage  FxWirePro: USD/CAD claws back some ground, but downtrend remains intact

FxWirePro: USD/CAD claws back some ground, but downtrend remains intact  FxWirePro: NZD/USD pulls back from 6-month high

FxWirePro: NZD/USD pulls back from 6-month high  FxWirePro: GBP/AUD gains some upside momentum but still bearish

FxWirePro: GBP/AUD gains some upside momentum but still bearish  FxWirePro: EUR/AUD gains some upside momentum but still bearish

FxWirePro: EUR/AUD gains some upside momentum but still bearish  EUR/GBP Slumps to 0.86598 — Bears Dominate While 0.86750 Caps Any Bounce

EUR/GBP Slumps to 0.86598 — Bears Dominate While 0.86750 Caps Any Bounce  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro: GBP/USD uptrend loses steam, remains on bullish path

FxWirePro: GBP/USD uptrend loses steam, remains on bullish path