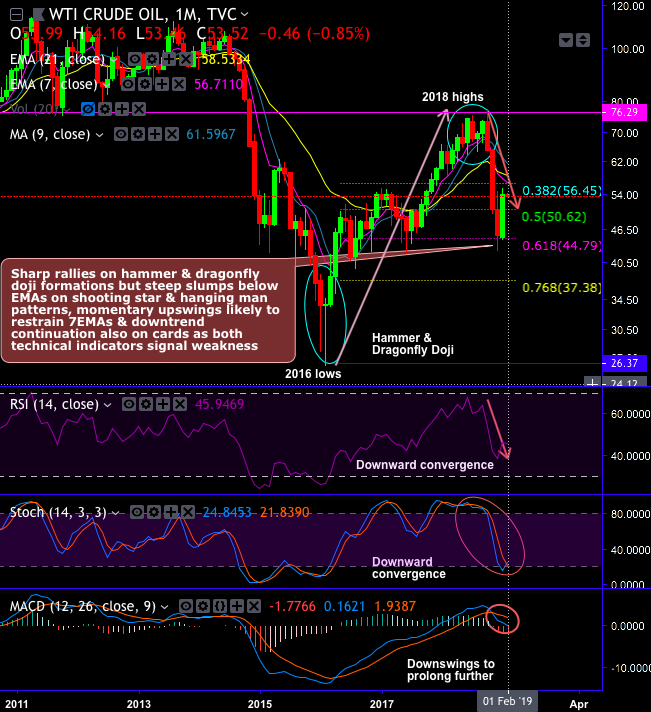

WTI crude has shown considerable price spikes, a tad below 19% (18.90% to be precise). As you could observe WTI has been attempting to consolidate but bearish risks are still prevalent (refer above price chart). The recent price rallies are predominantly driven by the striking of ‘Demand/Supply Equation’. Venezuelan factor has now bolstered energy prices.

WSJ reported that “amid political turmoil in Venezuela and subsequent U.S. sanctions on the oil-rich nation, crude prices are rising—and so are the number of rumors circulating among Venezuelans trying to make sense of the mayhem. One of these unconfirmed stories tells of a Russian plane seeking to take away some of Venezuela’s gold reserves. In Europe, several countries have banded together to defy U.S. sanctions and continue financial ties with Iran despite Washington’s objections. Lastly, a major California-based utility is trying to save its balance sheet by shedding renewable energy contracts, following a series of wildfires that saddled the firm with potential liabilities”.

Overall, one could foresee topsy-turvy swings the major trend of this energy commodity in 2019.

Trading Recommendations: Contemplating the above factors, anybody on this planet knows this rationale that when supply decreases with the increasing demand is forecasted, then the price of the commodity tends to shoot up. Hence, we’ve already advocated initiating longs in NYMEX WTI June 2019 and short NYMEX WTI December 2019 spread at - $1.19/bbl in the recent past, with a target of +$2/bbl and stop loss of -$2/bbl.

We also reckon that WTI would be well supported in the months ahead as Saudi Arabia is also reducing crude exports to the US strategically to reduce US inventories, the price gets a cushion in the near terms but the downside price apprehensions remain intact.

Initiate longs in NYMEX WTI June 2019 and short ICE Brent June 2019 at -$7.97/bbl. The target of -$6/bbl and stop loss of -$6/bbl. Courtesy: OPEC, ANZ, JPM

Currency Strength Index: FxWirePro's hourly EUR spot index was at 22 (mildly bullish), USD is at -62 (bearish), at press time 12:42 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025