The year 2019 was difficult for emerging market currencies, particularly due to an unfavorable external environment. We reckon that the external environment should be a bit friendlier next year and therefore the idiosyncratic factors of individual emerging economies will play a bigger role again.

Heading into 2020, the bar for a strong risk rally remains high. The late cycle will still keep the bar high for EM FX risk positions and these will need to be more tactical in nature in 2020, as they were in 2019. EM FX has historically weakened significantly at the end of a US business cycle and we do not think this cycle will be any different.

However, we expect that in 2020 external factors will provide some relief. First of all US President Trump might want to score during the forthcoming election campaign by reaching at least a temporary agreement with China. This significantly increases the likelihood of tension from the trade conflict easing. Moreover it is becoming increasingly clear that the massive recession fears of the past months were exaggerated. This situation allows us to come to the conclusion that the FX market is likely to increasingly focus on idiosyncratic, i.e. country-specific, factors in the coming four quarters.

We have positioned for the bounce in near-term activity indicators with a small OW in FX, but this remains purely a tactical recommendation. Technicals should remain a support for markets, with average valuations screening cheap, while both the ECB and Fed expand their balance sheets. This all sets up 2020 to be an episodic year for EM market views with bottom-up positioning being an important source of performance, in our view.

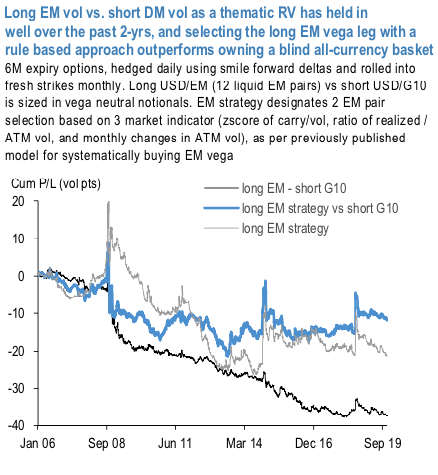

From a vol return standpoint, long EM vs. short DM as a relative value theme has not always been profitable due to typically high risk premia embedded in EM options. But this has begun to change over the past couple of years as vols have slid to multi-year lows even as geopolitical, economic and monetary policy uncertainty has increased. This new environment has particularly benefited the performance of high beta FX / EM options (refer black line in the above chart). Recent optimism on a Phase-I US/China trade deal has pushed VXY below 5%-tile of long-run history, meaning that EM FX options today carry razor thin risk premium over delivered vol.

We found that using a rule- based approach to systematically selecting EM currencies to buy 1Y ATM straddles drastically improves the risk-reward of a long EM vol strategy. Specifically, we found that a composite signal comprised of i) high z-scores of carry / premium ratios of ATMF straddles, ii) high realized / ATM vol ratio, and iii) strong momentum (% monthly change) in ATM vol delivered good outcomes in ex-anteselections of EM vols to buy.

In the above chart, we adapt this same heuristic to systematically buying EM vega, but this time also alongside selling G10 vega.

Encouragingly, returns from such a long EM / short DM vol strategy (blue line) have been trending higher since 2014 and have bettered long only EM vol (grey line) courtesy decay savings. 6M strikes us as good choice of tenor as a compromise between responsiveness to market shocks and decay costs.

At current market, ZAR screens as the top EM vega candidate due to favorable carry/vol and realized / implied vol ratios (6M USDZAR vol is nearly flat to trailing 1m realized vol); KRW and HUF are next in line.

Based on the implied – realized premium and curve shapes, we favor a basket of short 6M AUD, NZD and CAD vols to fund ZAR, KRW and HUF 6M vega.

Buy an equally weighted basket of 6M ATM straddles across USDZAR, USDKRW and USDHUF (indic. vols 13.35/13.75, 6.4/6.6, 7.1/7.6 respectively) vs. sell an equally weighted basket of 6M ATM straddles on AUDUSD and NZDUSD (6.7 and 7.25 change vols respectively). Courtesy: JPM

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays