EURJPY PPP and FEER valuations are the yen bear’s arch-enemies, but they apply far more to the USDJPY than to the EURJPY, given that the euro, too, is significantly undervalued on a PPP basis. The OECD puts EURJPY PPP at 136, while PIIE puts a FEER-consistent EURJPY rate at 121. More important perhaps than the valuations, however, is our confidence that the ECB is further along the road to policy normalization than the BOJ.

We’ve already stated that the Japanese government bonds fell on Wednesday as the Bank of Japan trimmed its purchases of Japanese government bonds maturing in 10 to 25 years in its buying operations held today. For now, the investors await the last monetary policy meeting of 2017, which is scheduled to be held on Thursday.

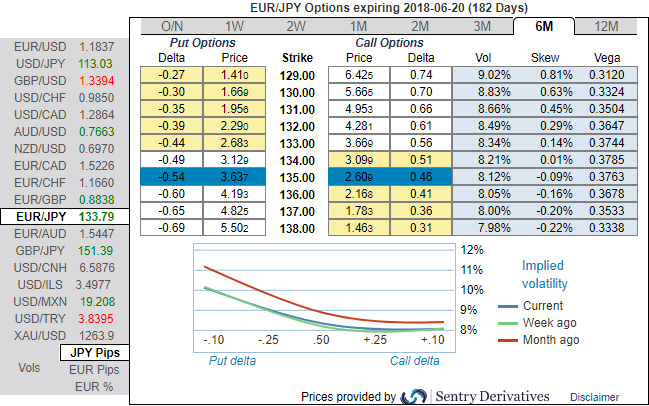

While please be noted that the bearish neutral risk reversals are still indicating bearish risks in longer tenors, while positively skewed IVs of the 6m tenor signifies the hedgers’ interests in OTM put strikes. These skews signal underlying spot FX to drop below 129 levels.

To substantiate this standpoint, if you observe the technical chart of this pair, the major trend has been rising higher above 50% fibos from the lows of 109.205 levels but restrained below 61.8%. The technical momentum indicators have also been substantiating overbought pressures in this consolidation phase (refer monthly chart). For more reading, refer our technical section.

Hence, keeping the both OTC and technical factors in mind, it is advisable to initiate below relative value trades.Buy 3M EUR puts/JPY calls vs. sell 3M 28D EUR puts/KRW calls for directional traders.

Buy 3m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds.

Sell 6M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 33 levels (which is bullish), while hourly JPY spot index was at -89 (bearish) while articulating (at 07:25) GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis