If at all anything unexpected is going to happen in Mexican monetary policy, then we expect a single 25bp hike this year, in December.

Banxico backed off from its hawkish rhetoric of a couple of months ago, and in the Quarterly Inflation Report signaled no urgency to hike.

Inflation will most likely remain below the central bank’s target in the next months and will probably average less than 3% this year according to Banxico.

The Mexican peso has lost over 35% in value against the U.S. dollar over the past three years. Over a 24-month period, it has lost 30% of its value. The reasons for this are as follows:

- the fall in the oil price, which has also taken place over the past two years (traditionally moves in tandem with the peso);

- an increase in the national debt (partly because of the fall in the oil price);

- the fundamental weakening in global growth in the first half of 2016, and

- the escalating uncertainty on the international financial markets and emerging markets.

Another factor has been the Brexit vote in UK in June 2016. Apart from Mexico's current account deficit of around 2.5% of GDP – not a fundamental problem, in our view – the last six months have seen a certain withdrawal from the money market, which could have been a contributory factor behind the fall in the peso.

However, this portfolio outflow may also be seen as a reaction to the gradual increase in the interest rate and should not necessarily be regarded as a sort of capital migration. The last dampening factor for the peso worthy of mention is that the latest opinion polls show a greater likelihood of Donald Trump being elected as the next US president.

Hedging Strategy:

We’ve already advocated this option strategy in the recent past, we urge to maintain the same option portfolio as the FX OTC market for USDMXN is intensified ahead of above fundamental scenario, 2W IVs are spiking above 18.17%.

During such scenarios, Vega is the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility. Vega is generally larger in options which have a longer time until expiry, and it falls as the option approaches expiry.

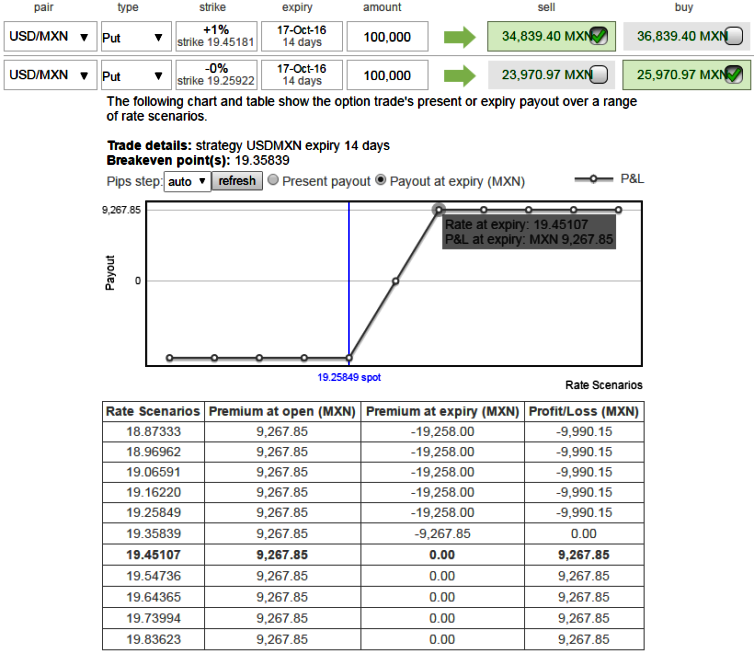

As we expect the underlying currency exchange rate of USDMXN to make a larger move on the downside. As shown in the figure purchase 1M 2 lots of At-The-Money -0.52 delta puts and sell 1W one lot of (1%) In-The-Money put option.

Please be noted that the expiries shown in the diagram are for the demonstration purpose only, use appropriate tenors as stated above.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated