RBA’s monetary policy meeting is scheduled on May 2nd; April’s central bank's board meeting minutes has been more dovish than previous months’.

1Q CPI next week’s focus; we forecast headline at 0.6% q/q and core at 0.4% q/q.

Terms of trade and private credit also important releases in the week ahead.

Kiwi CPI firmer than expected at 1%q/q, led by tradable inflation.

AUDNZD higher towards 1.0900 multi-day, global risk-aversion fading (AUD is more sensitive).

The medium term perspectives: Higher to 1.10. The cross remains well below fair value estimates implied by interest rates, commodity prices, and risk sentiment, although is closing the gap (6 Mar).

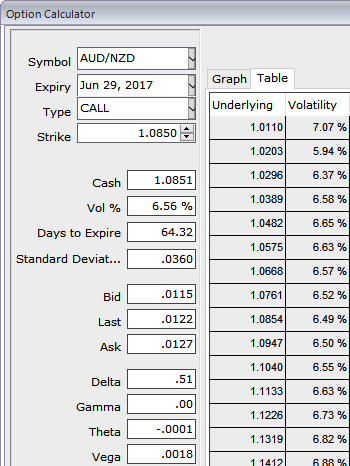

Please be noted that the IVs 2m ATM contracts have been tepid, creeping up at 6.56% which is on the lower side. An option writer wants lower IVs or IVs to fade away in an anticipation of premium to shrink away. You should also note short-dated options are less sensitive to IV, while long-dated is more sensitive.

Hence, amid lower IV environment, we advocate below option strategy:

Buying a 2-month AUDNZD 1.09-1.11-1.13 (1x2x1) call fly spread would likely keep underlying price fluctuation on the check.

BEP at 1.0848 and returns are likely when underlying spot FX keeps flying above these levels.

Long butterfly spreads are entered when the investor thinks that the underlying spot FX would not spike nor drop dramatically by expiration. Deploying calls, the long butterfly can be constructed by buying one lower striking ITM call, writing two ATM calls and buying another higher striking OTM call. A resulting net debit is taken to enter the trade.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different