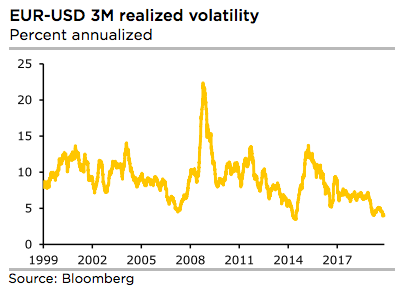

For the past three months the EURUSD exchange rate has been moving in a range of roughly 2 cents. Only in 2014 did the cross temporarily move even less than that. At the same time the market increasingly expects the low volatility to become a permanent feature which is reflected in the falling implied exchange rate volatilities. And this sad state of affairs is by no means limited to EURUSD, but can be observed across the entire G10 universe.

Since the start of the year our G10 volatility index has been falling to new historical lows on an almost daily basis. In the following we will explain the reasons for this trend as well as give an outlook.

Activity data has stabilized in the Eurozone but not yet improving. The much-awaited PMIs hardly delivered any satisfaction to EUR bulls — while the manufacturing components did indeed tick up, the services were weaker leaving the composite unchanged on the month. The ECB meeting this week didn’t deliver much new information, but the underlying message was of policy accommodation for as long as the eye can see.

Last week, we noted that the failure of the data to improve in a decisive manner (let’s say the composite PMI towards the upper-end of the one-year range in the 51.5-52 region), would subject the euro to the drag from negative rate spreads for at least another month, and probably leave these options facing terminal decay.

Hence, we unwind part exposure to bullish EURUSD trades. The EURUSD call spreads was part financed by selling EURNOK topside; we take profits on this structure this week. The view is still NOK- bullish within G10 high beta FX, but the pairing vs. EUR amid signs of renewed global growth uncertainty and weak Norwegian developments lead us to tactically unwind exposure to this trade. Partially unwind bullish EURUSD trades; keep bullish exposure via a digital call.

Long a 4M 1.15 digital EUR call/USD put. Paid 11.5% on Nov 26th, marked at 3.24%.

Long 4M EURUSD 1.12/1.15 call spread vs. short 4M EURNOK 10.25/10. 50 call spread. Cost 15.5bp in November, marked at 11bp. Courtesy: JPM & Commerzbank

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges