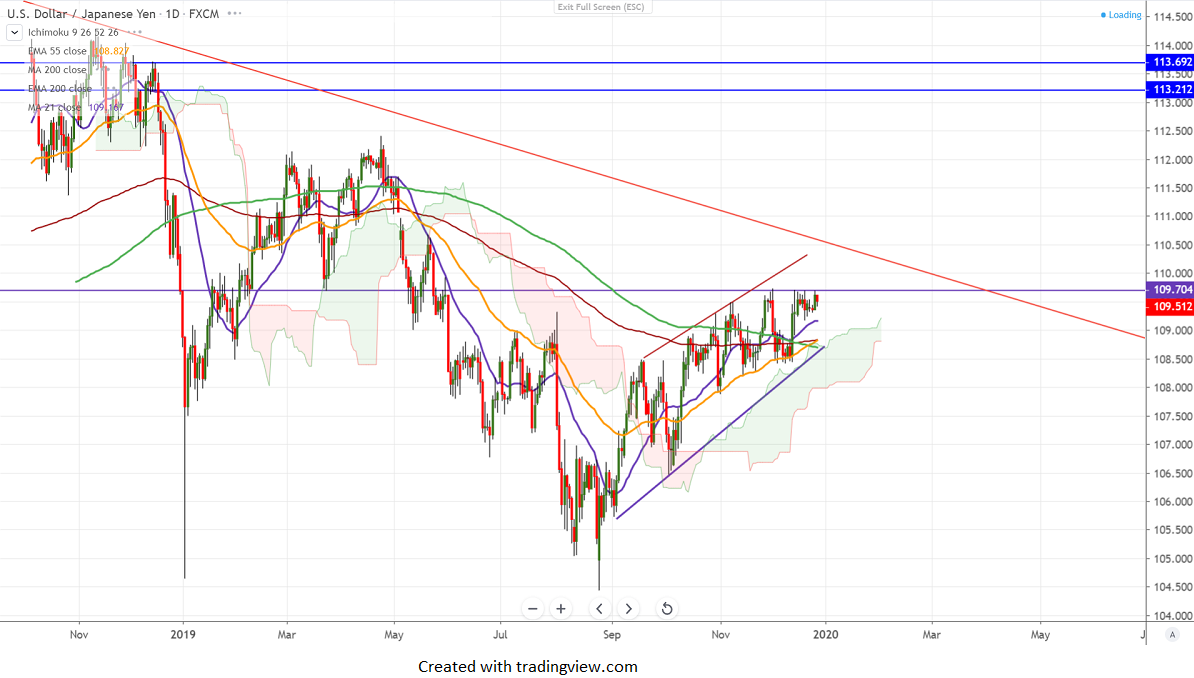

Ichimoku Analysis (Daily Chart)

Tenken-Sen- 109.31

Kijun-Sen- 109

USDJPY is consolidating in a narrow range and once declined slightly after hitting a high of 109.68. The pair has formed a temporary top around 109.72 and any major bullishness only above that level. US-China trade optimism is putting pressure on Safe-haven demand like yen and gold. China has purchased nearly 2.6 billion more than double compared with imports in October as both sides preparing for signing a Phase one trade deal. It hits an intraday low of 109.43 and is currently trading around 109.497.

Technically, near term support is around 109.40 (10- day MA) and any violation below will drag the pair down till 109.15 (21- day MA)/108.80/108.30/107.80 Any break beneath 107.80 targets 106.50.

On the higher side, major resistance is at 109.75, the breach above will take the pair to the next level 110/110.60.

It is good to buy on dips around 109.15-20 with SL around 108.70 for the TP of 110.60.