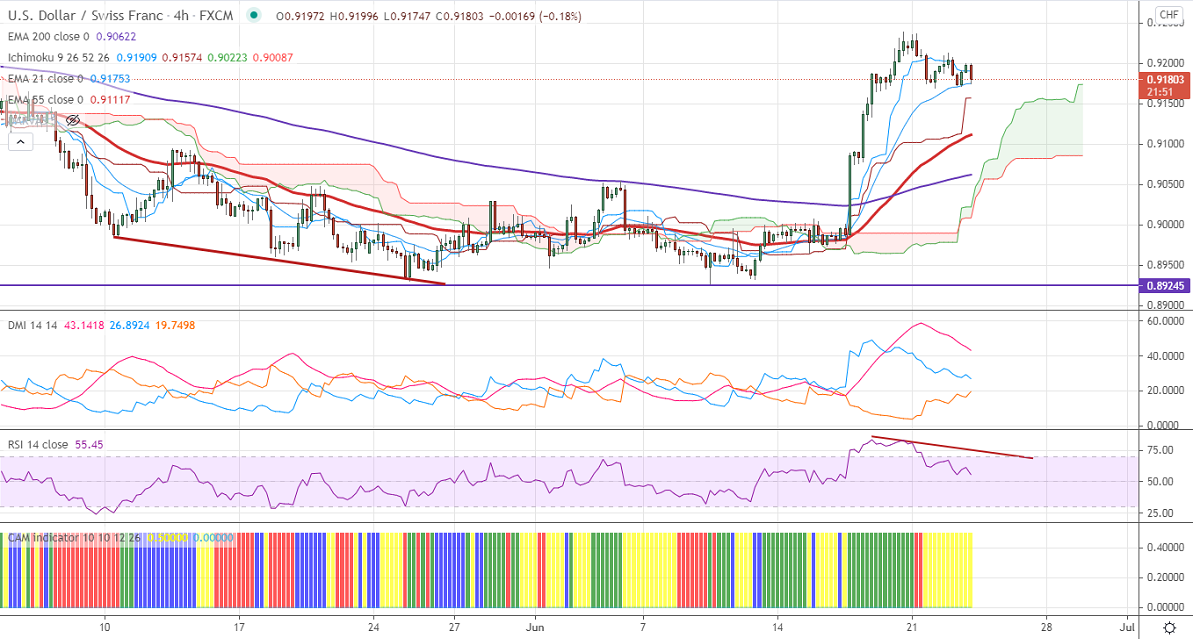

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.91909

Kijun-Sen- 0.91571

USDCHF is trading in a narrow range after hitting a high of 0.92388. The comments from Fed Chairman Powell show that rates will not rise so soon. US dollar index is struggling to close above 92 levels; any breach above 92.50 confirms a bullish continuation. The US 10-year bond yield surged more than 10% from a minor low of 1.354%. The pair hits an intraday low of 0.91798 and is currently trading around 0.91800.

Short term outlook:

In the 4-hour chart, RSI has formed bearish divergence. So minor decline till 0.9120 not ruled out.

Trend- Bullish

The pair is holding below 4-hour Tenken-Sen, and above the cloud, Kijun-Sen. The near-term resistance is around 0.92500. Any indicative break above will take the pair to next level to 0.9300/0.9340. On the lower side, near-term support is around 0.9170. Any convincing breach below targets 0.9120/0.9080. Significant selling will happen only if it breaks 0.8920.

Indicator (4-Hour chart)

CAM indicator – Neutral

Directional movement index –Neutral

It is good to sell below 0.9170 with SL around 0.9220 for a TP of 0.9060.