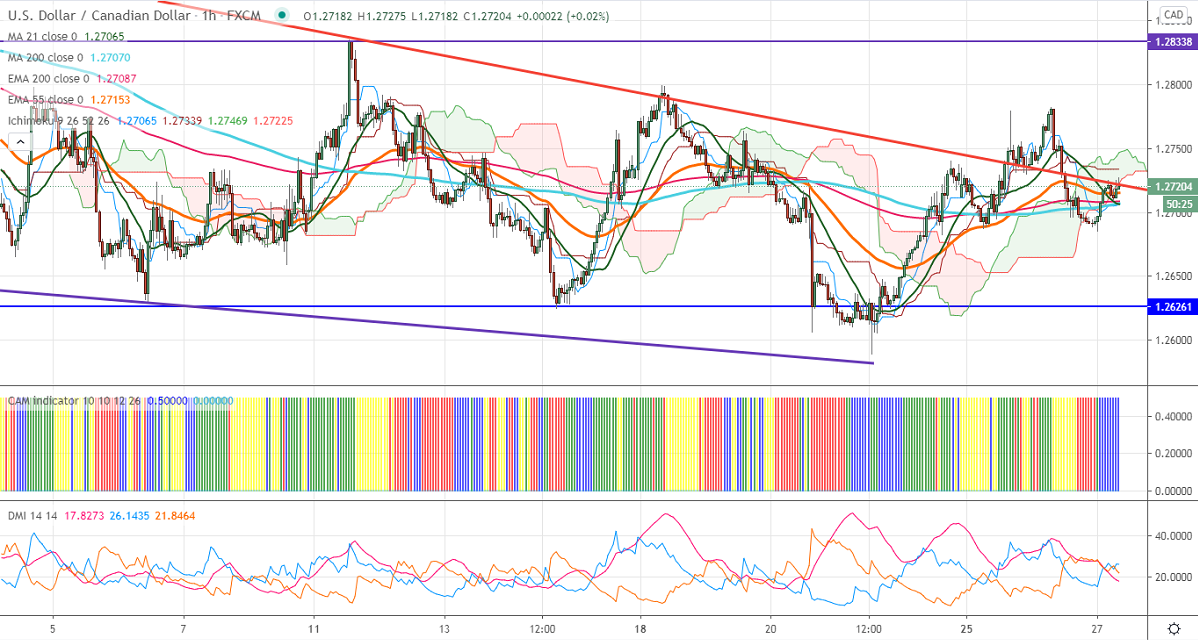

Ichimoku analysis (4-Hour Chart)

Tenken-Sen- 1.27054

Kijun-Sen- 1.27339

USDCAD is showing a mild recovery after a massive sell-off in the past 3 months. The pair lost more than 6% on broad-based US dollar selling and upbeat market sentiment. The Bank of Canada has said that depreciation of the US dollar is not good for the Canadian economy. USDCAD hits an intraday high of 1.27253 and currently trading around 1.27203.

WTI crude oil took support near 55-4H EMA and shown a minor jump. The overall trend is bullish as long as support $51.50 holds. But surging coronavirus and economic growth uncertainty are putting pressure on oil at higher levels. Any violation above $54 confirms bullish continuation, a jump till $55 likely.

Technically, the pair faces near term resistance at 1.27505. Any indicative break above will take till 1.27705/1.2800/1.2835. The near term support is around 1.2680 an indicative violation below will take to the next level till 1.2650/1.2600.

It is a good buy on dips around 1.2700 with SL around 1.2650 for a TP of 1.2798.