EURSEK is unchanged over the past month, albeit once again the cross briefly flirted with the upper end of the six-year range at 9.60-9.70.

We expect continued range-trading through until year-end and then only very modest appreciation from SEK through next year (9.35 by end-16 and 9.15 by Q3’17).

The catalyst for a major break higher in SEK is lacking – a definitive end to the Riksbank easing cycle and a tangible prospect of rate hikes within a 6-9 month time frame.

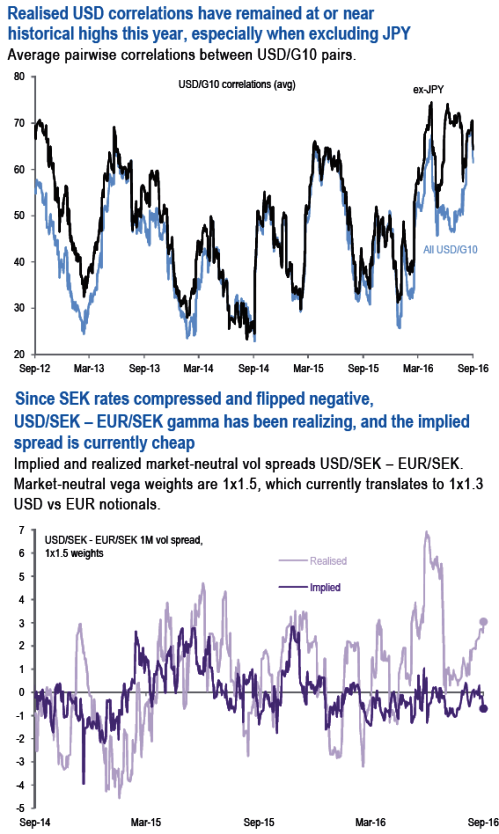

In the case of SEK, long positions in USD vols can be advantageously coupled with short vols in the EUR cross.

Long gone are the days when the market was testing the Riksbank’s nerves in the low 9.0s in EURSEK. The latest Swedish data do point to a rebound from slowing economic momentum.

However, this did very little to improve sentiment and lift SEK, as the undershoot in the country’s Economic Activity Surprise Index (EASI) is second only to NZD among the pairs we track .

With the market looking for negative rates to extend to Q3 2019 – a good 1y past the Riksbank’s forward guidance, it is unlikely that SEK attracts significant inflows, and “we expect continued (EURSEK) range-trading through until year-end”. This range-bound outlook on EURSEK – which the price action around German.

Financials woe doesn’t question, should play its part in keeping USD correlations at historically firm levels, especially when removing the BoJ-led effect of JPY. It is, therefore, supportive of a USDSEK vs EURSEK vol spread trade.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic