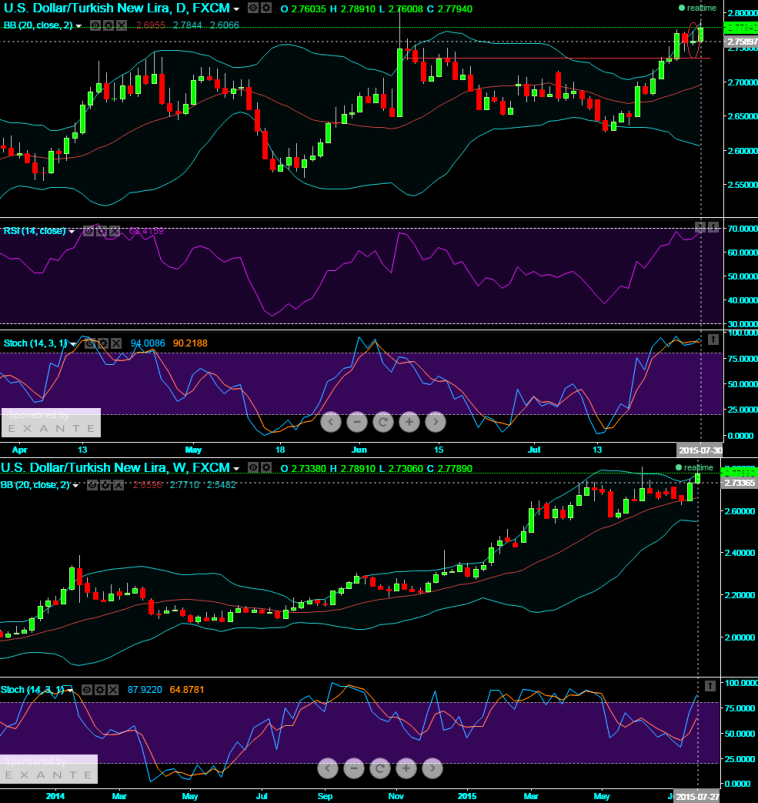

On daily chart of this exotic pair, shooting star pattern candle formed at peak of upswings but it should not be interpreted as reversal signal as there are no substantial confirmation from any other indicators and trend reversal can't be deemed in an isolation. Weekly chart still looks handsome for bulls as clear %K line crossover with rising prices.

Turkey is likely to benefit from improved medium-term policy prospects, eventual resolution of political uncertainties, and greater monetary policy independence compared to its history.

Over the medium term, we expect Turkey to ultimately benefit from a more inclusive government and greater monetary policy independence. On the flip side, advance Q2 GDP of US is improved from previous -0.2% but remain below forecasts, while jobless claims have printed the upbeat numbers at 267K which is well below forecasts at 270K, both these numbers from US perspectives seem positive in terms of economic performance.

Thus, with both technical and fundamental reasoning it is good to buy this pair at every dips as shooting star pattern can be utilized more optimal entry points. We see strong support at 2.7580 levels any breach below this level would drag this pair upto next support at 2.7488 levels.

FxWirePro: USD/TRY shooting star formed at peak; TRY’s healthy macro dynamics unlikely to tame dollar’s bull run but tiny corrections on cards

Thursday, July 30, 2015 12:52 PM UTC

Editor's Picks

- Market Data

Most Popular

3

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?