Before we move onto the core of this write-up, please be noted that USDSGD has risen by around 2% since the start of June to around 1.3630, in line with the weakness in Asian currencies led by CNY’s drop, and the near term bias is still to the upside. The pair has tilted higher by 3% since early May, a hefty move compared to historical standards, yet in an orderly manner, which has allowed keeping realized vol (1M realized at 4.0vols) and, as reflect, implied vol (at 5.0vols) contained. Were trade tensions to unfold more abruptly, it would be natural to imagine a drop associated with higher realized volatilities.

Conversely, as discussed in the previous section, its “safe haven” status within the area, as for instance reflected by the lower interest rates (which normally call for higher vols), could support the choice of TWD as a candidate the short-vol leg of the trade.

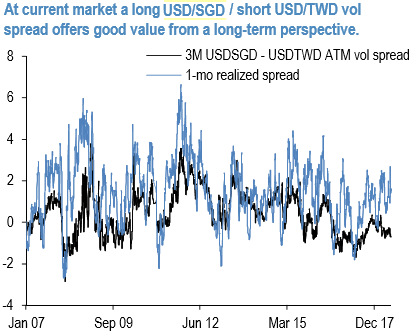

Currently, the Vol Carry embedded on the USDTWD front end of the curve is wider than for USDSGD. From a long-term perspective (refer above chart), the long USDSGD / short USDTWD vol spread offers value, given the favorable current level of Carry and the relative dynamics of realized volatilities; if we exclude episode of early 2011, realized volatility has usually spiked more violently on USDSGD than for USDTWD, thus supporting the long-vol leg of the RV trade. From a purely directional perspective, SGD might not be the optimal candidate for owning optionality and hedging a proper tail event in the region.

Owning optionality on a high-beta class would rather be preferred in an ideal scenario, with potential for high realized vol in a risk-off market. Despite not being a high-beta asset per se (if measured against moves in DXY or S&P Indices), the much higher betas of SGD relative to TWD support owning vol on the former rather than on the latter, putting aside idiosyncratic factors that could stimulate higher volatilities mostly on Taiwan denominated assets.

Thus, the carry-friendly nature of the trade combined with its modest downside risk offers a handsome risk-to-reward trade-off, thus stimulating the choice of SGD as the long-vol leg, despite the relatively contained potential in a bearish market. Also, given the idiosyncratic factors at play on TWD, suppressing directional sensitivities, the mean reversion potential of the trade is limited (as measured in terms of weak auto-regressive properties for the spread), which reduces the interest of adding Vega exposure via long-dated maturities.

On these grounds, compared to the earlier piece, we tend to favor the shorter (3M) end of the curve for increasing the sensitivity to the realized vol differentials, thus highlighting the carry-friendly nature of the vol trade rather than its pure hedge potential. This aspect of the USDSGD – USDTWD vol spread has been a potent P/L generator since 2016.

We advocate to Buy 3M ATM USDSGD straddles @ 5.025 choice vs short 3M USDTWD straddles @5.55/5.95 indic, both legs delta hedged, in vega neutral notionals. Courtesy: JPM

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures