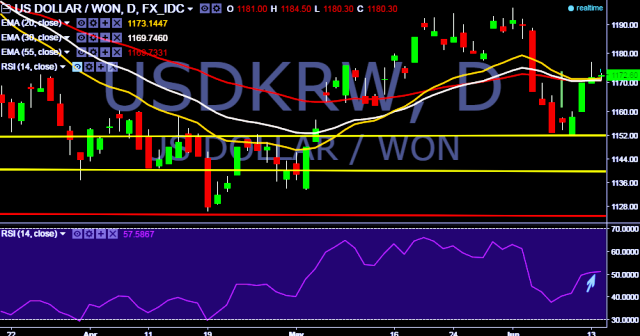

- USD/KRW is currently trading around 1172 levels.

- It made intraday high at 1173 and low at 1170 marks.

- Intraday bias remains bullish till the time pair holds key support at 1162 marks.

- A sustained close below 1162 will tests key supports at 1152, 1142 (20D EMA)/ 1134/1127 (October 2015 low) /1121/1115 levels respectively.

- Alternatively, a daily close above 1176 will drag the parity higher towards key resistances at 1182, 1196 (June 01, 2016 high), 1201, 1209 (20D EMA) and 1220 (March 03, 2016 high) marks respectively.

- In addition, South Korea’s Kospi was trading 0.43% lower at 1,970.17 points.

We prefer to take long position in USD/KRW only above 1176, stop loss 1162 and target 1182 marks.