USD/JPY chart - Trading View

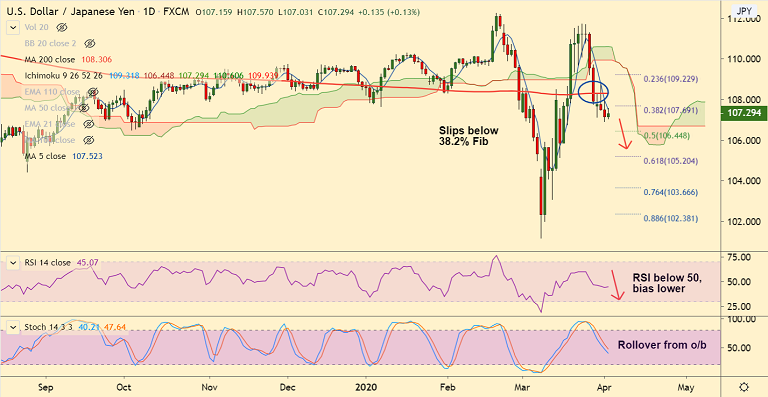

USD/JPY has slipped below 38.2% Fib, bias is strongly bearish.

The major was trading 0.12% higher on the day at 107.27 at around 09:30 GMT, after closing 0.31% lower in the previous session.

The ADP Non-Farm Payrolls and the ISM Manufacturing Purchasing Managers’ Index released on Wednesday beat expectations, but failed to benefit the US dollar.

Focus now on jobless claims report for the week ended March 21st. Goldman Sachs foresees 5.25 million claims.

Technical indicators are turning bearish. Stochs and RSI are now biased lower. MACD shows bearish crossover on signal line.

Upside was capped at 5-DMA at 107.52. Bearish 5-DMA crossover on 20-DMA adds to the bearish bias.

Immediate support lies at 106.44 (Kijun sen and 50% Fib). Further bearish momentum could see test of 61.8% Fib at 105.20.

Support levels - 107, 106.44 (Kijun sen and 50% Fib), 106, 105.20 (61.8% Fib)

Resistance levels - 107.52 (5-DMA), 108.30 (200-DMA), 108.75 (50-DMA)

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data