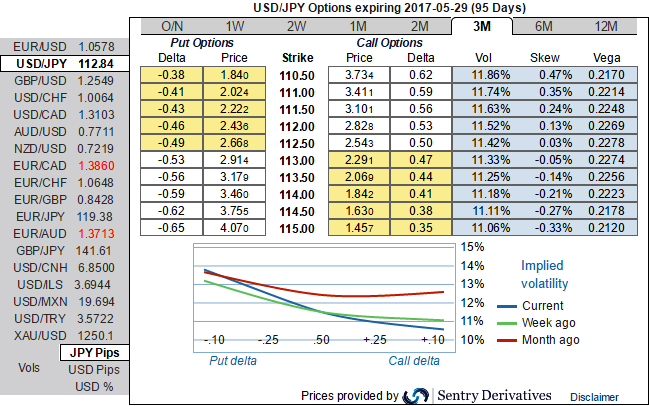

At spot reference: 112.89, USDJPY 3m risk reversals and IVs are indicating mounting hedging interests for downside risks (while articulating).

While 1m IVs have collapsed 16 points to 11.16% and 3m IVs are spiking at around 11.89%.

When IV increases and you are holding an option, this is good. Unfortunately, if you have sold an option, it is bad. Option writer expects IV to shrink away so the premium would fade away. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

The positively skewed IVs of 3m tenors are indicating the hedgers’ interest in OTM put strikes.

With bearish-neutral risk reversal, we wouldn't be surprised even if the underlying spot FX evidences the interim spikes, bears likely to drag again towards 112.169 and 111.450 levels sooner or later

Hence, we deploy ITM puts with longer tenors in our option strategy as the delta risk reversals favor bearish targets, hence in order to keep the risks on either side on the check we reckon diagonal debit put spreads are best suitable as the IVs and premiums are reasonable considering daily swings on technical charts.

So, here goes the strategy, Debit Put Spread = Go long 3m (1%) ITM -0.49 delta Put + Short 1m (1.5%) OTM Put with lower Strike Price with net delta should be at around -0.40.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Glimpse over fundamentals: The fortunes of the dollar has been the dominant focal point of FX markets, with the dollar index down 2.2% over the past month, retracing nearly half of the post-election dollar rally into the end of last year on a reassessment of Trump policy expectations.

But dollar weakness in the past month has not been solely attributable to this. Positive data surprises and economic forecast revisions in the rest of the world make the US less exceptional and thus justify less strength in the USD, simply based on contemporaneous cyclical data.

The unwind of post-election dollar strength is now mature, judging from positioning indicators, short-term valuation models, and the price action itself. This suggests that while incoming information from Washington will continue to drive near-term broad dollar outcomes, that it may be less of a singular dominant driver, and that other macro developments outside Washington may take greater focus.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?