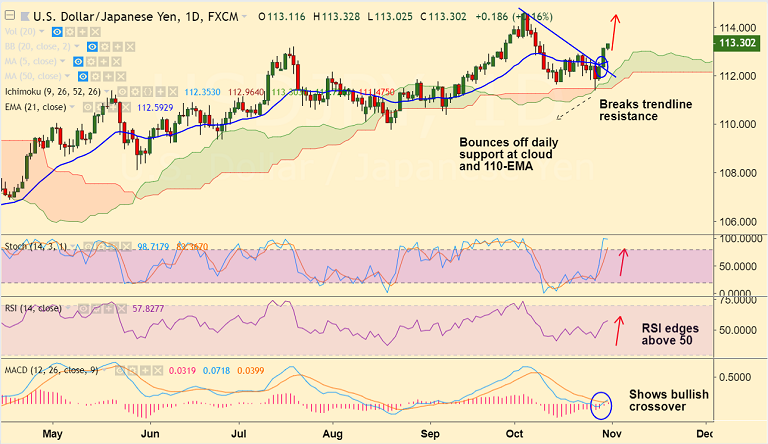

USD/JPY chart on Trading View used for analysis

- BoJ holds policy unchanged, as widely expected. Holds rates at -10bps while maintaining 10yr JGB yield target at 0.00%.

- The central bank also made no changes to a new forward guidance, pledges to keep interest rates extremely low for an extended period.

- The central bank made downward revisions to the Japanese growth and inflation forecasts.

- The pair is consolidating previous sessions gains above 113 handle and is poised to extend its advance up to 113.40 (Sept 8 high).

Support levels - 112.60 (5-DMA), 112.20 (55-EMA), 111.54 (110-EMA)

Resistance levels - 113.40 (Sept 8 high), 114, 114.55 (Oct 4 high)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-USD-JPY-bounces-off-daily-cloud-positive-momentum-likely-to-continue-good-to-go-long-on-dips-1450650) has hit TP1/2.

Recommendation: Book partial profits at highs. Hold for further upside.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure