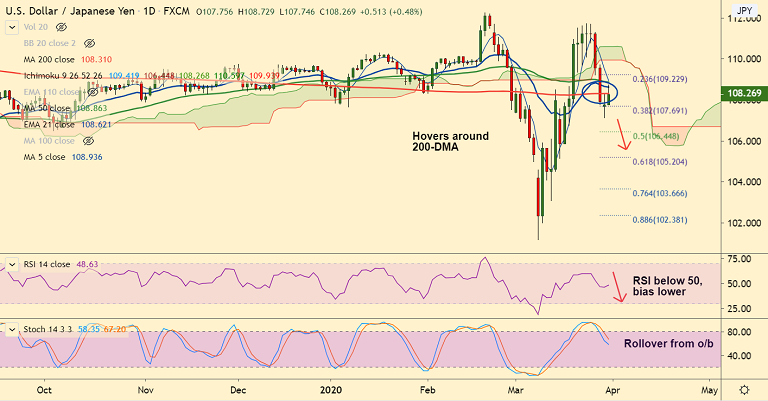

USD/JPY chart - Trading View

USD/JPY was trading 0.63% higher on the day at 108.43 at around 04:10 GMT.

The pair is holding onto recovery amid resurgent US dollar demand. Monday's Doji candlestick formation also aids gains on the day.

The Greenback ended broadly higher on Monday on short-covering as global central banks and governments launched monetary and fiscal measures to battle the economic fallout.

The risk-on action in the Asian equities combined with surprising positive Chinese PMI data also support gains.

Data released earlier today showed China’s manufacturing PMI stands at 52.0 vs 35.7 previous release (expected 44.9). While non - manufacturing PMI stands at 52.3 vs 29.6 previous release (expected 42.1).

Technical studies are indecisive. Major and minor trend are neutral. Failure to close above 200-DMA will see downside resumption.

Decisive breakout at 200-DMA could see near-term upside. Next major hurdle aligns at daily cloud at 109.93.

Support levels - 107.69 (38.2% Fib), 107.12 (Mar 30 low)

Resistance levels - 108.31 (200-DMA), 108.62 (21-EMA)

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure