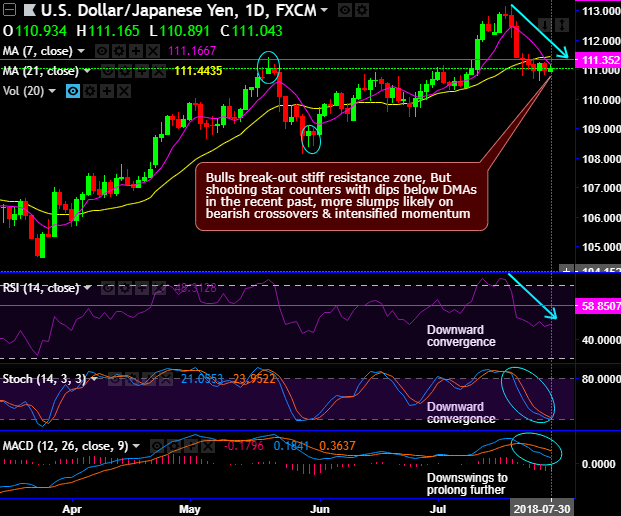

- USDJPY has formed shooting star patterns at 112.835 (on the daily chart) and 111.422 levels (on weekly plotting) amid today's mild rallies as market nudges trade war tormentor but seems to have considered BoJ and Fed’s monetary policy season again this week.

- The current trend is wedged between 111.352 and 110.769 levels after the formation of hammer pattern at 111.220 levels on the contrary to the above bearish patterns (refer daily charts).

- On intermediate trend, bulls are retracing from the March 2018 bottom of 104.629 levels to the November 2017 highs, will foresee further upside traction upto next 61.8% Fibonacci levels (refer weekly plotting). Price action on this timeframe has bounced back into the long lasting range bounded trend. But the pair has failed to sustain its bullish momentum and slid back below the 50% Fibonacci level. As a result, you can trace out shooting star formation at that juncture.

- The major trend has been bearish, but 7-EMA likely to act as the major support at 110.667 levels. We see bullish invalidation on retrace below.

- Both leading oscillators (RSI and fast stochastic curves) are signalling intensified bearish momentum on both time frames and trend confirmation (both lagging indicators, DMA & MACD show bearish crossovers) on daily plotting. We could foresee the scope for further upside traction only if it bounces above DMAs.

- While Yen seems to be gaining its traction via safe-haven sentiments.

Key Support Levels: 110.667, if it breaks this level then you could see dips upto 110.260 areas that are regarded as next strong support zones.

Trade tips: On every dip, it is wise to buy tunnel options spreads, with upper strikes at 111.352 and lower strikes at 110.667.

Alternatively, on hedging grounds, at spot reference: 111.073 levels, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 109 levels in the medium-run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -27 (which is bearish), while Hourly JPY Spot Index was at 58 (bullish) at 08:21 GMT.

These figures are also conducive to the above-stated options strategy.

For more details on FxWirePro's Currency Strength Index, visit below web-link:

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says