Although USDJPY kept spiking 3-4 days, today changed hands at 100.840, down 0.17%, the pair trades at the largely similar level to that around a month ago.

However, JPY has weakened against most other majors over the period. As a result, JPY has declined by over 1% in trade-weighted terms.

The main view on USDJPY in coming months remains unchanged; we expect the pair to be range bound with some downside risks, mainly due to expected USD weakness, not JPY firmness.

Although we expect USDJPY to break the recent low at 99 at some point in coming months, the pair is unlikely to accelerate its downward moves.

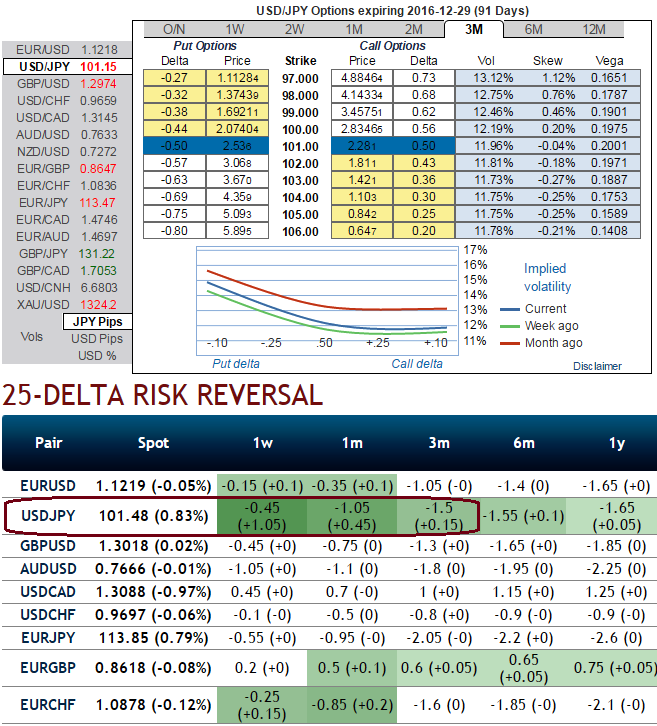

Volatility shocks and the passage of time have opposite effects on the value of a vanilla option (see ATM strikes on USDJPY options). When it can benefit from more volatility (long vega and gamma on OTM put strikes), time has a negative impact every day (short theta).

Yen IVs: Live September meeting should keep 2M vol supported; while yen 1-3m risk-reversals still a better sale as Fed considers global slowdown risks and Bexit settlement which is why the US central bank keeps deferring rate hikes at least until the end of 2016 or by Q1 of 2017.

Please be noted that the 3m IV skews are more biased towards OTM put strikes, significant changes can indicate a change in market expectations for the future direction in the underlying forex spot rate and these risk reversals evidences the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market.

Please be noted that the skewness in implied volatility of 3m tenors of this pair signifies the hedgers interest in OTM put strikes.

While delta risk reversals of the similar expiries reveal more sentiments in hedging activities for downside risks in the similar tenors (3m expiries). This would raise a cause of concern that in this phase of time, the major economic events are likely to intensify volatility in FX markets.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data