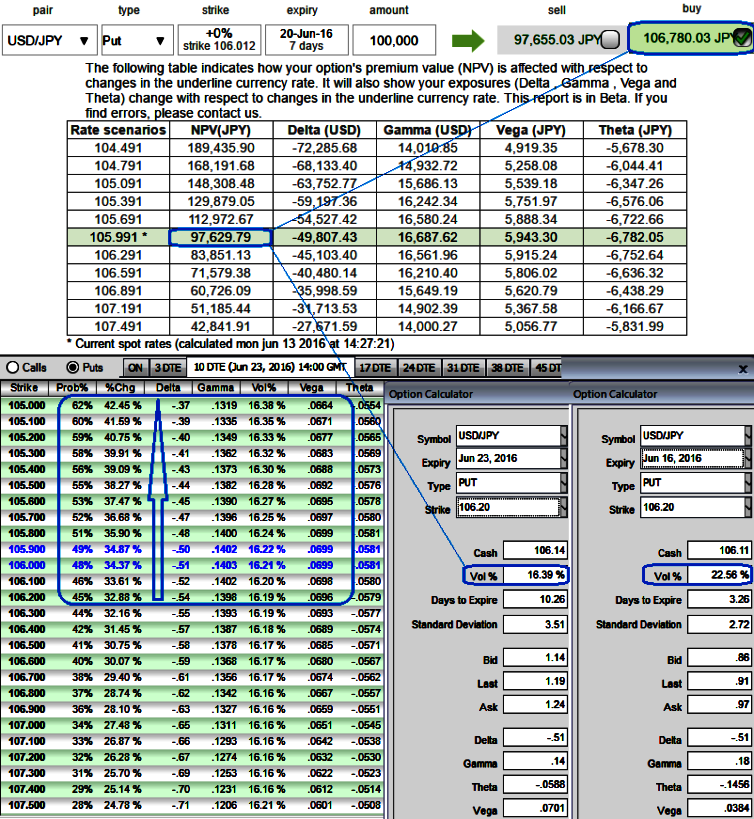

The ATM IVs of USDJPY of 1w expiries are trading at 15.65%, while ATM premiums are trading 9.37% more than NPV.

Since the Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows, FX traders need to be cautious while choosing the fairly valued options.

The components of option value include intrinsic value, its time value and the implied volatility of the underlying asset.

So contemplating the difference in the option value and its IVs of the same tenor, we think put premiums are fairly priced in.

Well, being right or wrong doesn’t matter as long as your portfolio is able to generate positive cash flows as per George Soras.

How much more money you made when you are right and how much less you lost when you are wrong is all that matters.

There exists the role of shrewdness in our hedging or speculative strategies, which instruments to use (futures, options, forwards or what not). To move a step ahead, if it is to be selected FX options then which strikes are to be selected.

If you observe the sensitivity table, we tend to choose the OTM strikes of 10 Days to expiry so as to spot out the more productive and to give a leveraging touch to FX portfolios as these put instruments of OTM strikes evidence the healthy gamma and higher vols with higher probability numbers. This would mean that the more likelihood of expiring in the money on expiry.

On the other hand, while hedging for downside risks if you’ve chosen OTM strikes then you would be on competitive edge as these contracts would likely benefit in two ways, one that is to reduce hedging cost as OTM contracts would be cheaper than ATM and secondly, more chances of tackling negative risk reversals as per the above Greeks computations.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge