The US-Chinese trade negotiations were not exactly simple so far, but now the whole thing is getting even more complicated. After the House of Representatives almost unanimously passed the Hong Kong Bill that envisages sanctions against China should the status of Hong Kong as a special administrative region be under threat the trade negotiations have become almost inseparable from the events in Hong Kong.

On the other hand, Chinese President Xi Jinping broke his silence on trade talks, and says that Beijing wants to work for a trade deal with the United States but is not afraid to "fight back" to protect its own interests. “We want to work for a ‘phase one’ agreement on the basis of mutual respect and equality,” Xi said. However, President Trump later responded: “I told President Xi, ‘This can’t be like an even deal. We’re starting off from the floor and you’re already at the ceiling'.” Such rhetoric indicates that there is little chance that both sides could find a balancing point any time soon, although China is making some progress on intellectual property protection as over the weekend the government announced some new measures to improve the IPR process.

However, the sticking points remain as China does not want to commit a specific amount of farm goods purchase and the US is reluctant to roll back existing tariffs. For the FX markets, neither "good news" nor "bad news" have big impact for now. It seems only "breaking news" can move the market.

Amid such a geopolitical turmoil, although USDCNH has resumed its bull-run from last week or so, and the pair has jumped above 21DMAs but for today little edgy, trading at 7.0332 levels.

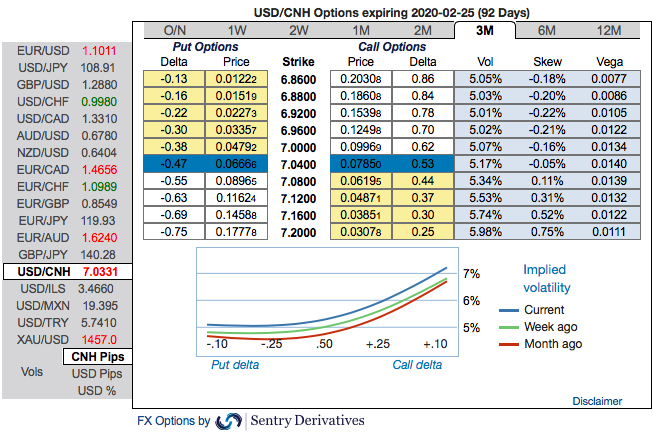

Trade Strategy: At this juncture, we remain short in CNH via 3-month (7.00/7.25) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations. The positively skewed IVs of 3m tenors indicate that the upside risks of USDCNH are foreseen, OTM call bids up to 7.20 (refer above chart, spot reference: 7.0332 levels). Courtesy: Sentrix & Commerzbank

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays