Bullish USDCAD scenarios above 1.30 driven by:

1) NAFTA renegotiations break down and breakup fears return.;

2) US growth expectations upgraded on policy driving a broad $ rebound

Bearish USDCAD scenarios below 1.20 driven by:

1) Local oil prices remain sustainably above $60/bbl triggering a renewed investment cycle

2) Severe deterioration of US politics and geopolitics dent US growth expectations and further widen out the broad dollar discount much further.

OTC indications and options strategy:

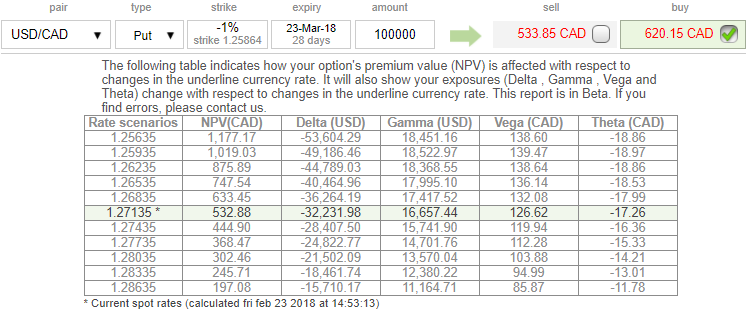

Despite the prevailing bullish sentiments, we at EconoTimes advocate to choose write options instruments, otherwise, even if the analysis is accurate, you may not fetch the desired results. Please note that the 1% OTM put option of 1m tenor seems to be overpriced 16.5% more than NPV, whereas, the ATM IVs of this tenor is well below 8%. This disparity should not ruin our trade objective even though our trend prediction turns out to be true.

As you can see 1m IV skews have been well balanced, this signifies the hedgers’ interests on both OTM call and put strikes. While risk reversals have been indicating upside risks, using three-leg strategy would be a smart move to reduce hedging cost.

Hence, these overpriced put options are conducive options writers.

Risk-averse traders who are uncertain about trend directions, go long in USDCAD 1M at the money -0.49 delta put, and go long 2M at the money +0.51 delta call and simultaneously, Short 1w (1%) out of the money puts. Thereby, we slightly favor bulls as we foresee more upside risks by keeping longer tenors on call leg. But by having written overpriced OTM put likely to reduce the cost of hedging.

While it is reckoned that as per the OTC indications as shown above and the prevailing trend in USDCAD options markets seem to be reasonably addressed by hedging participants, thus, we advocate below option strategy to keep uncertainty in spot USDCAD prices on the check.

On trading perspective also, the strategy likely to fetch positive cashflows regardless of underlying price swings with more potential on the downside and with cost-effectiveness.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying above 189 levels (extremely bullish), while hourly USD spot index was at -51 (bearish) while articulating (at 09:45 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data