USDCAD bullish scenarios above 1.37 if:

1) NAFTA withdrawal;

2) Canadian growth slowdown extends vis-à-vis US;

3) Local/global oil prices weaken despite cutbacks

4) Political crisis worsens

USDCAD bearish scenarios below 1.28 if:

1) USMCA ratified ahead of schedule;

2) BoC reverts to hawkish rate path;

3) A broad US dollar discount returns because of political risks.

Potential risk events: BoC monetary policy decision & MPR on May 29th, Canadian GDP on May 31st; Payrolls on June 7th.

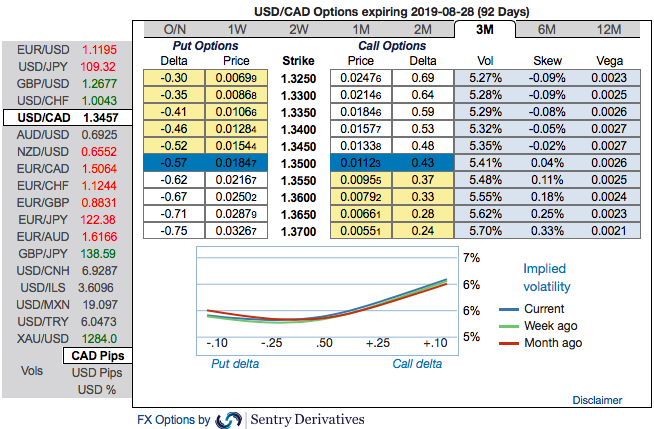

USDCAD OTC indications and options strategies:

At spot reference: 1.3447 level, we advocate diagonal call options spreads foreseeing both mild abrupt downswings in the near-term and the major uptrend.

Contemplating above driving forces, diagonal call spreads as preferred option structures seem the most suitable in prevailing circumstances given elevated skew and favorable cost reduction.

Execute USDCAD 3m/2w call spread strategy (strikes 1.34/1.36) for a net debit.

The rationale: As you could observe the underlying spot of USDCAD has dipped below 1.34 level with bearish sentiments from two months, hedgers’ interests turned onto the negative shift in risk reversals in shorter tenors along with shrinking IVs (implied volatilities).

Short calls are most likely to expire worthless, so that the option writer can be rest assured with the initial premiums received.

3M ATM IVs are trading between 5.27% - 5.70%, positively skews are also suggesting the odds on OTM call strikes up to 1.37 levels at this juncture. Please notice bullish neutral risk reversals that signal upside risks in the risk-neutral distribution of returns. Also, the IV curve is at, or slightly decreasing, with maturity.

Favor optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Maintain the net delta of the position above 70% as shown in the above nutshell and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25% as you could see skews of 2w tenors are well-balanced on either side.

Maximum gain is achievable when underlying spot FX move above OTM strike with ideal risk-reward.

By shorting the out-of-the-money call, the options trader finances the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. Source: JPM, Sentrix, & Saxobank

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -174 levels (which is highly bearish), hourly USD spot index was at -53 (bearish) while articulating at (09:35 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise