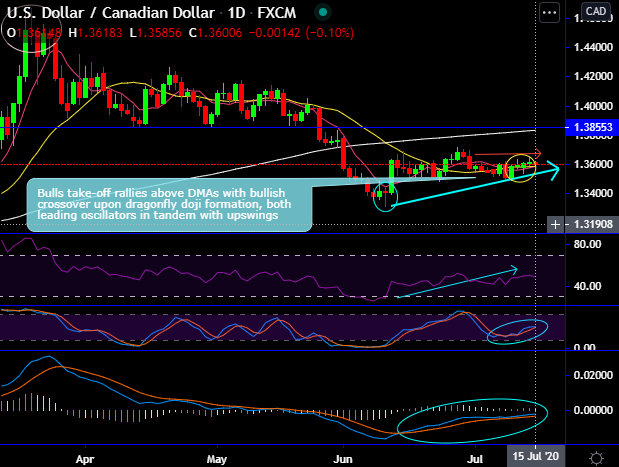

Although USDCAD bulls take-off rallies above DMAs with bullish crossover upon dragonfly doji formation at 1.3411 levels, the pair continues to lack significant upside momentum to detach itself from the 1.3600 anchor cleanly as gravestone doji patterns pop-up at 1.3590 and 1.3571 levels. While both leading oscillators in tandem with upswings.

Nevertheless, the slight upside bias prevails despite the soft USD, perhaps on the back of a soggy crude complex.

On a broader perspective, the major uptrend that was spiking through the uptrend line so far, though the failure swings were observed at the peaks of 1.4667 levels the bears attempt to create some downside traction but they appear to be vulnerable in the major trend.

For now, as it has signalled only momentary weakness as the current price slides below 7 & 21-EMAs, one can think of some trading ideas using boundary strikes.

Overall, we continue to reckon that further upside pressure on the USD will emerge gradualy as the H2 of 2020 develops. Key resistance now is 1.3855 and major resistance is 1.4667.

Trading tips: At spot reference: 1.3601 levels (while articulating), boundary options strategy is advocated using upper strikes at 1.3716 and lower strikes at 1.3505 levels. One can achieve certain yields as long as the underlying spot FX remains between these two strikes on the expiration.

Alternatively, we recommend long hedges as BOC policy decision is scheduled today (1400 GMT), and there is chance that the pace of quantitative easing may be picked up. This should inherently impart some upside pressure on the pair.

Hence, stay longs in USDCAD futures contracts of Aug’20 deliveries with an objective of arresting potential bullish risks in the major trend.