As the U.S. economic and foreign policies decouple from the rest of the world (President Trump’s stance on Jerusalem, NATO, Iran nuclear Agreement, Trans-Pacific Partnership, Paris Climate Accord), so do its economy and financial markets. After decades of globalist policies, under president Trump, it has taken a sharp turn towards nationalism and protectionism.

So far, it has been working out fine for the United States. U.S. economic growth hit 4.2 percent last quarter and Fed’s ‘GDP Now’ data shows that it was not a one-time event. The next quarter could be even better. This comes at a time when Europe is still struggling and weakness is visible in many emerging market economies.

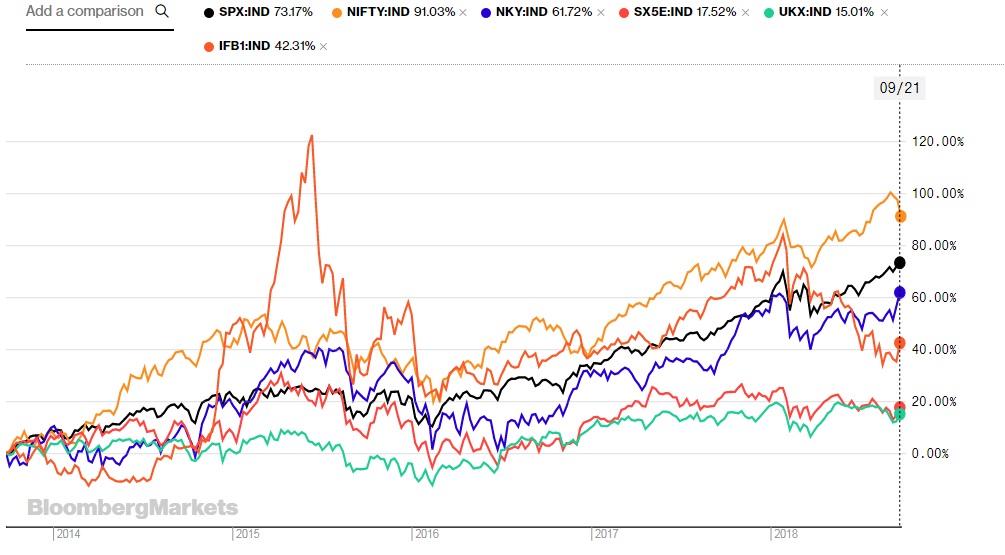

Similarly, U.S. financial markets have been decoupling from the rest of the world. So far in 2018, the U.S. benchmark stock index has returned +8.3 percent, whereas India’s nifty has returned +5.1 percent, Nikkei has returned +1.9 percent, Eurostoxx50 has returned -2.3 percent, same as FTSE100, and China’s benchmark CSI300 has returned -17.4 percent. This might seem just another outperformance, the trend is becoming more and more visible. And we believe that it is here to stay.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure