Just as the market was craving any clear-cut statement on the Fed’s future interest rate policy in the run-up to the last FOMC meeting, regardless of how clearly they are staking out a rate rise in December. It simply brushes them aside.

The market is aware of the fact that there is still a considerable chance that this rate rise too will be postponed again - as happened so many times before. Should Donald Trump really emerge as the winner of the elections on 8th November the risks will no doubt rise again in the Fed’s view.

Concerns that could easily cause the Fed, and above all Fed chair Janet Yellen, to refrain from a rate rise with a reference to the uncertain (global) conditions. The market wants to avoid this trap. Hardly surprising therefore that there is certain indifference about the USD on the markets that remains unaltered by US data. That is unlikely to change short term.

OTC outlook and hedging frameworks:

Please be noted that the skewness in implied volatility of 3m tenors of this pair signifies the hedgers interest in OTM put strikes. While delta risk reversals of the similar expiries reveal more sentiments in hedging activities for downside risks in the similar tenors (3m expiries). This would raise a cause of concern that in this phase of time, the above stated major economic events are likely to intensify volatility in FX markets.

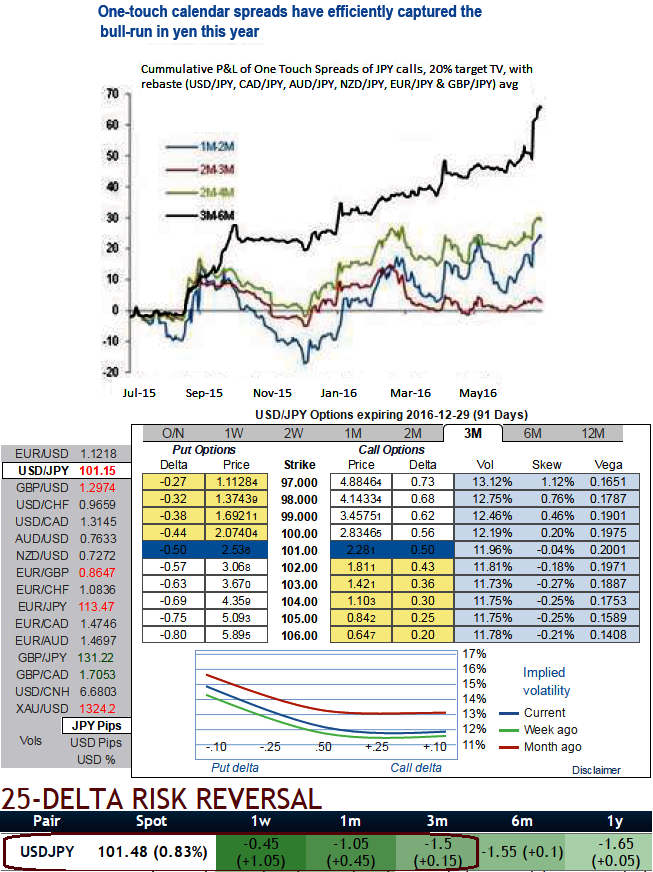

Vega-neutral USDJPY calendar spreads, on grounds that the vol curve is inverted in the 3M-1Y sector and that ex-BoJ day, realized vols are soft compared to ATMs (3M ATM 11.65 vs. ex-BoJ realized vol 10.5).

This class of trades has worked well for us this year given the persistent flatness of the yen curve, and we have often exploited the set up via one-touch calendar spread which is also a genuine directional alternative to straddle calendars in this instance.

The above chart shows that such structures have performed well in capturing the yen’s bull run this year, and function best on a basket of yen-crosses for short 3M vs. long 6M tenors.

Applied to USDJPY, this would suggest short 3M 94 vs. long 6M 94 one-touches that cost 13% to buy in equal USD notionals, and roll up to 25% in 3- months time should spot remain around current levels i.e. static carry gains of roughly 100% of the upfront premium.

The hope, of course, is to thread the needle by virtue of gentle yen appreciation over the next three months that stops short of breaching 95 – possibly as intervention concerns come to the forefront – and can lead to 2X-5X returns on upfront premium depending on terminal spot levels.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says