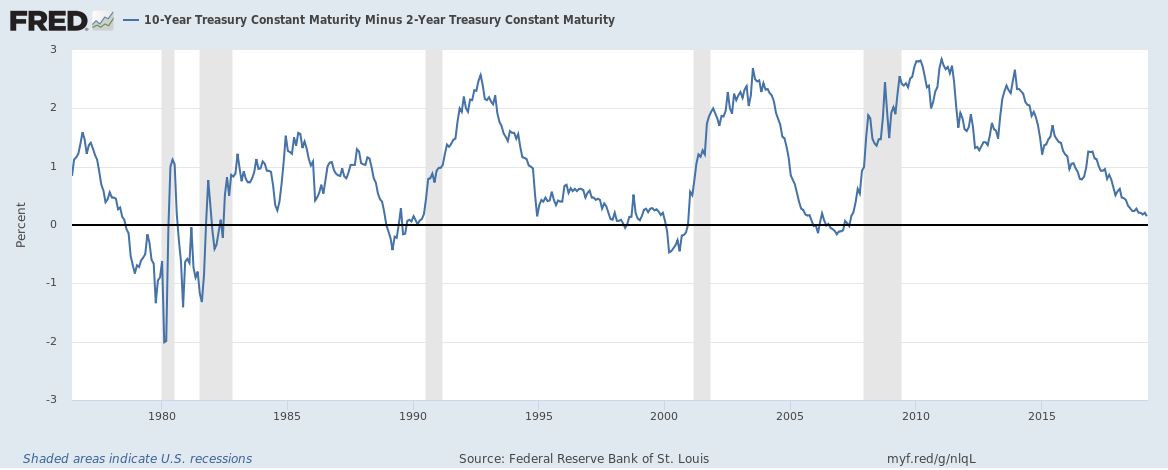

There are many indicators like PMI reports, jobs reports, inflation, industrial output, business sales etc. that we take a look into in determining whether the US economy is slowing down and heading for a recession but there is one indicator we are not losing sight of which is widely considered as the most reliable predictor of a recession and that is the yield difference between a 10-year U.S. Treasury bonds and a 2-year treasury bonds.

This chart from the St. Louis Fed’s economic dashboard shows that the spread has correctly predicted the last five recession. Every time before the US economy suffered a recession, the spread dipped below zero. Recession follows within 24 months, whenever spread dips below zero.

The spread has been steadily declining since 2014, as the U.S. Federal Reserve raised interest rates from 0.25 percent to 2.25 percent, pushing short-term rates higher, while lower inflation expectation pushed long-term yields lower.

Despite the downturn, a journey towards zero is still likely to be a long process and the possibility of an immediate recession in the United States remains a far-fetched idea. The spread is currently at 15 bps.

U.S. GDP growth also suggests that the recession is still a far-fetched idea. Despite the recent slowdown, the U.S. economy grew by 2.6 percent y/y in the fourth quarter.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains