The dollar tended to strengthen in the past few rounds of trade tensions; however, at this juncture dollar has been falling like a stone although the US-China relations are sour. Putting this into CNY's perspective, this will translate into a somewhat lesser depreciation pressure versus USD, while the sentiment might still drive the Chinese currency to the weak side.

As a result, CNY will depreciate more against non-USD currencies, such as EUR. For those operating in China while importing machines from Germany, this is certainly not a piece of good news.

However, for the Chinese authorities, this might create a "sweet spot" for them - They don't need to worry about capital outflows that could be triggered by expectations of large depreciation, and a relatively weak currency would benefit the export sector which actually employ millions of workers. All told, there seems no directional trend for the CNY but downside risks in the medium-term.

OTC Outlook & Hedging Strategy:

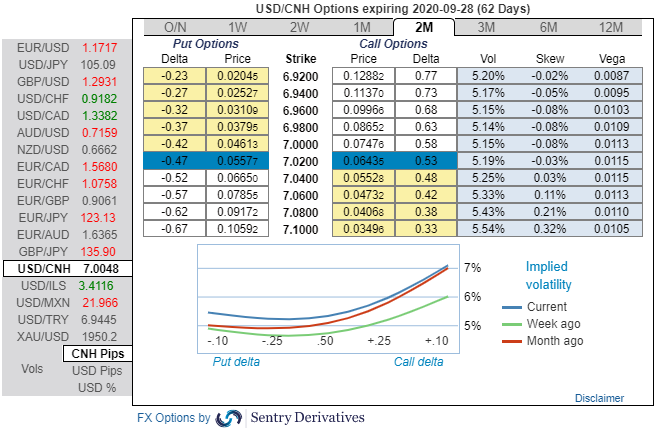

Please be informed that the positively skewed USDCNH IVs of 3m tenors still indicate the upside risks, they are still bids for OTM call strikes up to 7.10 levels.

At this juncture, we uphold our shorts in CNH on hedging grounds via 3-month (6.96/7.15) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations, (spot reference: 7.0048). Courtesy: Sentry & Commerzbank

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms