Today’s GDP figure will be released at 8:30 GMT from the Office of National Statistics (ONS). It is the first flash estimate of the third quarter GDP. The data is of extreme importance as it would represent the performance of the economy over a quarter after the referendum in June.

- The number, however, unlikely to be a key influencing factor for the pound and the FTSE100 as the focus has now shifted to the politics of the referendum. Data, other than GDP figure has already shown that the UK economy has performed better than expected. Retail sales, PMI reports, industrial production; all have been better than expected.

Past trends –

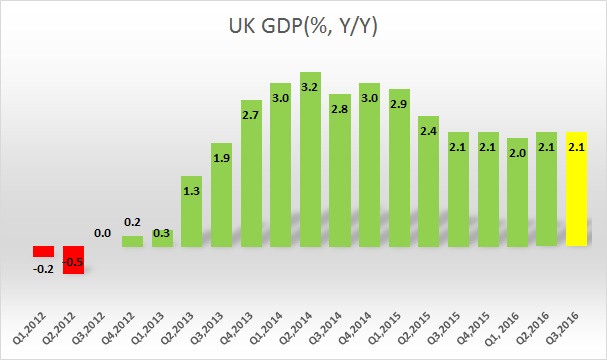

- After the 2008/09 crisis, the UK economy has been growing at the fastest pace among its OECD peers.

- GDP growth reached the highest level in the second quarter of 2014, reaching 3.2 percent growth on yearly basis. Since then growth has somewhat waned. In last quarter of last year, growth was 2.1 percent y/y, same as the third.

- This year, the economy grew 0.4 percent in the first quarter and by 0.7 percent in the second quarter on a quarterly basis.

Expectations today –

- Today, GDP growth is expected at 0.3 percent q/q and 2.1 percent y/y. However, we suspect that the data might outperform expectations.

Impact –

- The pound is currently trading at 1.221 against the dollar. The sterling has reached our forecasted short-term target of 1.2. We have also forecasted for the pound to drop to parity in the longer run.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound