A drop in risk appetite – reflected in broad losses for global stocks, a drop in commodities and a bid for bonds – has helped lift the G-10 FX safe havens and pressure the commodity currencies. The JPY and CHF are out-performing on the session while the SEK, NOK, and NZD (after weak unemployment data) are at the base of the overnight performance league for the majors.

In the range-trading, low vol market, it is timely to look for opportunities to fade expensive USD-correlations, a theme already introduced in the Global FX Strategy 2019 Outlook.

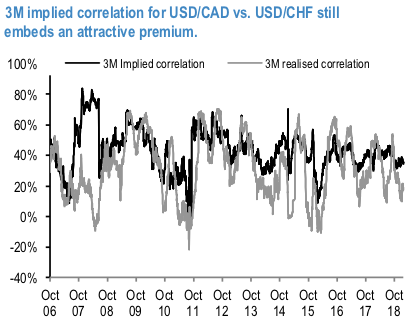

We look for USD/G10 pairwise correlations whose metrics might still look attractive in the current market keeping in mind that implied USD-correl levels have started to subside in Q4 last year (Theme reversion: U-turn in 2018’s signature FX vol trends in the new year,). One such a candidate might be found on the 3M USDCAD vs USDCHF correlation. With current implied (3M realized) correlation at 36% (16%), the correl premium is around 20 corr points wide (refer 1stchart). The entry point for the trade might look less appealing than a few months back, given the latest slow decline in the implied correlation.

We consider below a few different implementations (via exotics and plain vanillas) of the mismatch above. Note that a drop in implied correlation could be achieved via a rise in the cross CADCHF vol: this modest bearish tilt (consistent with Renewed NAFTA risks mean CAD weaker for longer), combined with a positive Carry (thanks to the correl premium), should allow a good performance of the trade in case where risk conditions were to deteriorate again.

The most direct implementation of the trade is via correlation swaps.

We simulate a proxy PnL generated by the short correl swap strategy by assuming zero transaction costs and the strike of the correl swap matching the ATM calculated as 3M implied corr = (2⁄3) ∗implied correlation (refer 2ndchart).

P/Ls simplistically 2M implied corr − (1⁄3) ∗1m realized corr. With these caveats in mind, we see that the trade has consistently delivered positive returns, and especially so at times when the correlation premium was wide, like over the past few months. We propose selling a 3M correlation swap on USDCHF vs USDCAD at 22.6/34.6%. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly CAD is at -25 (mildly bearish), hourly USD spot index is inching towards 125 levels (bullish), while articulating at 12:58 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms