The Fed meeting staged no major fireworks in FX beyond the initial knee jerk. Oil markets are remaining quite jittery with the overall setup so far supportive of petro currencies. We argue that such backdrop should keep a lid on petrocurrencies selloffs, if any, and by extension pose a unique opportunity for fading rich USD/petro skews (i.e. firm oil should put downside pressure and/or suppress USD/ccy up moves).

In the past we discussed USD/high beta put ratio spreads which are set up as net short vol structures on safe side of the skew and tend to exhibit attractive Sharpe ratios but are slow in harvesting P/L. This week bounce in oil, which according to our analysts should stick for longer, provides fertile environment to more aggressively collect skew theta in such pairs as USDMXN and USDRUB, via outright selling of risk reversals (more risky proposition considering that trailing spot-vol correlations have been performing) or via our preferred 1*2 ratio call spreads, delta-hedged. The1*2 ratio call spread structure is still exposed to blowups (left tail risk), thus tactically appropriate only as long as the petrocurrencies remain well anchored by the recent oil supply shock.

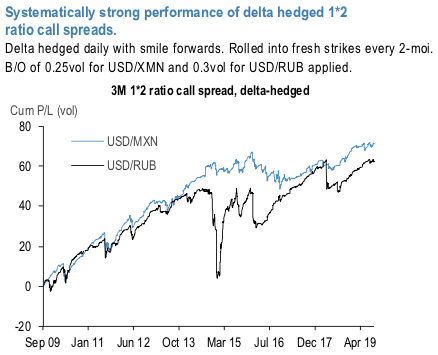

The 1st chart shows systematically strong performance of delta-hedged 1*2 ratio call spreads outside of the left tail episodes which hit RUB on a number of occasions (devaluation, sanctions, global risk offs).

The analysis in 2nd diagram shows that 1*1.5 and 1*2 structures capture the bulk of the Sharpe Ratio benefits. We assess the performance over last 10 year period, inclusive of the risk off episodes. Going further out and reducing relative weight on the long vol (nearer strike) leads to diminishing of the built-in protection of the ratio call spread structure during the risk off episodes resulting. Overall, 1:1.5 to 1:2 are the sweat spot among the 1*N ratio call spread structures. Hence we consider:

Sell 3M USD/MXN 25D risk reversal, delta-hedged @2.05/2.3 indic

or as a safer alternative:

Own 3M USD/MXN ATM/25D 1*2 ratio call spread @10.15ch vs @11.4/11.65 indic, delta-hedged, in vega notionals. Courtesy: JPM

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics